Many sole traders don’t always claim all the allowable expenses they’re eligible for. It’s completely understandable – while claiming big business purchases is a no brainer, the little everyday ones can potentially slip through the cracks.

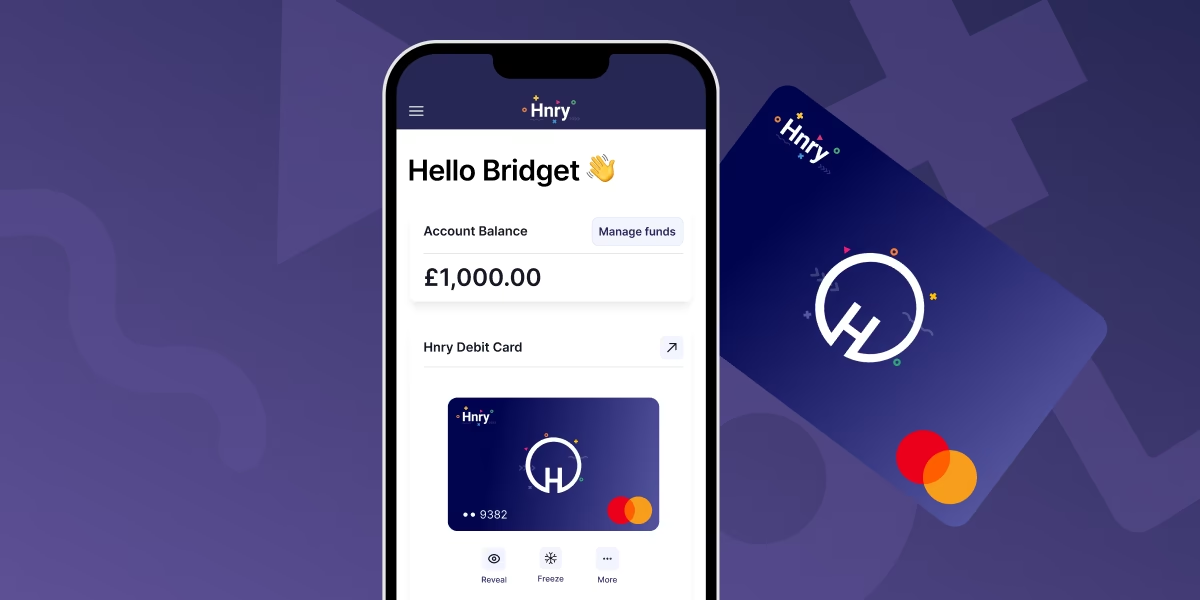

So we’re pretty excited to announce the launch of the Hnry Business Mastercard – a neat little tool to help capture and claim every business expense, and get you that sweet, sweet tax relief as you go.

The Hnry Business Mastercard is a virtual Mastercard, only it’s directly connected to your Hnry Account. Every time you use your card to purchase a business expense, a new expense is raised under the “Expenses” tab. Once you upload your purchase receipt and add a few details, the expense will be managed and claimed as per usual.

Sweet!

Best of all, the Hnry Business Mastercard is included as part of the 1% +GST Hnry fee (capped at £600 +VAT a year) – no sign-up costs, no extra bank fees.

With the Hnry Business Mastercard, it’s now easier than ever to keep track of and claim business expenses. Never miss an expense claim again!

- Why use a Hnry Business Mastercard?

- How the Hnry Business Mastercard works

- Using your card

- Other important features

Why use a Hnry Business Mastercard?

Great question! You know how when you make a business purchase, you have to keep the receipt? For at least five years (as required by HMRC)?

And then at the end of the financial year, you have to dig out all these receipts again and figure out what you’re claiming, when you bought it, and for how much? And add all these details to your Self Assessment? Before calculating the final amount of tax you owe?

Yeah, not fun. Enter the Hnry Business Mastercard.

With a Hnry Business Mastercard:

- All your business transactions will be recorded in one place

- Expense claims are raised automatically with each purchase, ready for you to upload the receipt and add a few last details

- You can then forget about that receipt – we store it for you for the required five years. No receipts-in-an-old-shoebox necessary.

- All your raised expenses get managed and claimed for you by the brilliant and devastatingly attractive Hnry team. We’ll include it all in your Self Assessment, and you’ll get the tax relief in real time.

If you’re already an avid Hnry User who doesn’t have to worry about doing their own taxes, a Hnry Business Mastercard still makes it easier to get all the tax deductions you’re eligible for.

It’s like becoming a Pokémon master – gotta claim ‘em all!

💡 If it’s getting close to the end of the financial year, you can still sign up for and use your Hnry Business Mastercard at any point. Just remember to add photos of your receipts to expenses raised in the app, and we will review and manage them like any other expense!

How the Hnry Business Mastercard works

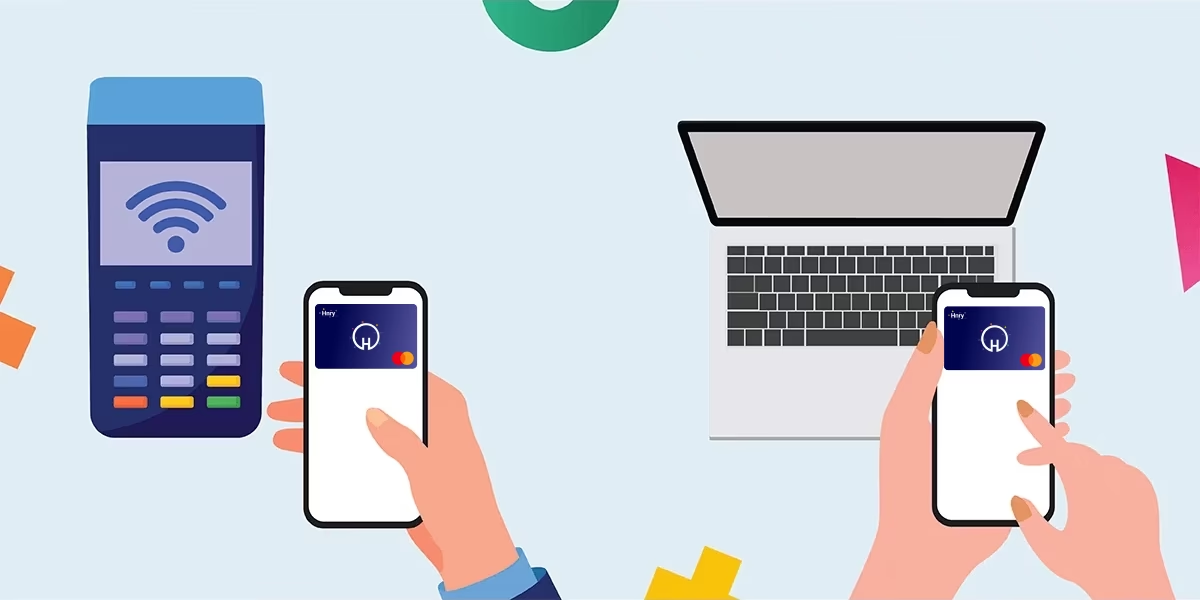

The Hnry Business Mastercard is a virtual Mastercard. You can use your Hnry Business Mastercard details to shop online, or add them to Apple Wallet or Google Wallet to complete your transactions in store.

To get started using your Hnry Business Mastercard, you’ll need to:

- Access your card details

- Add your card to Apple Wallet or Google Wallet

- Top up your Hnry Business Mastercard (via your Hnry Account)

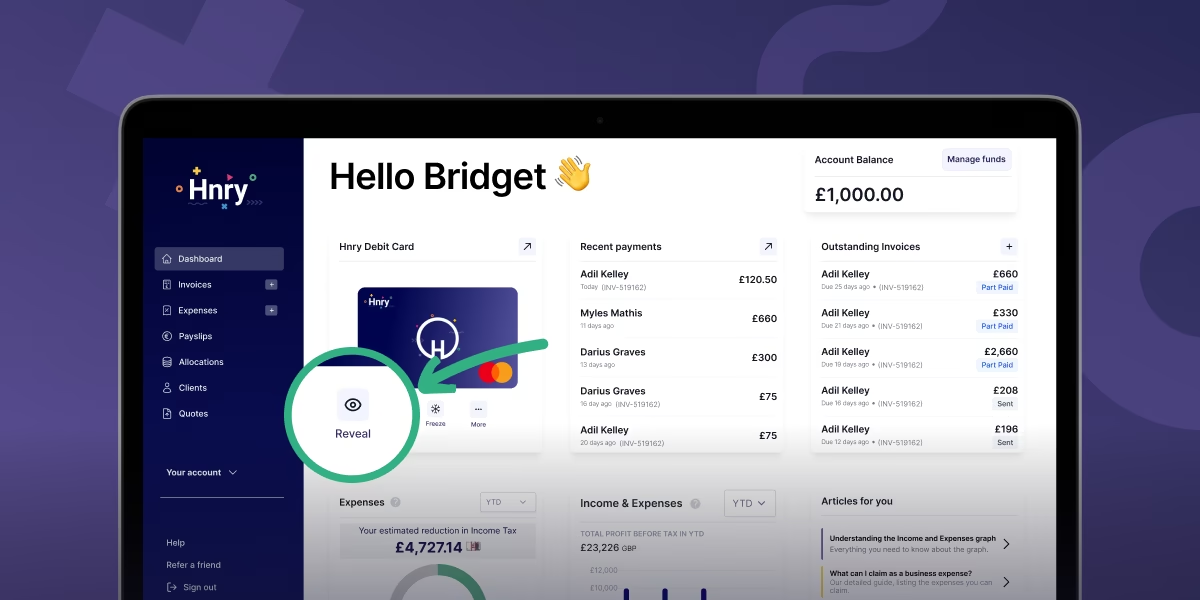

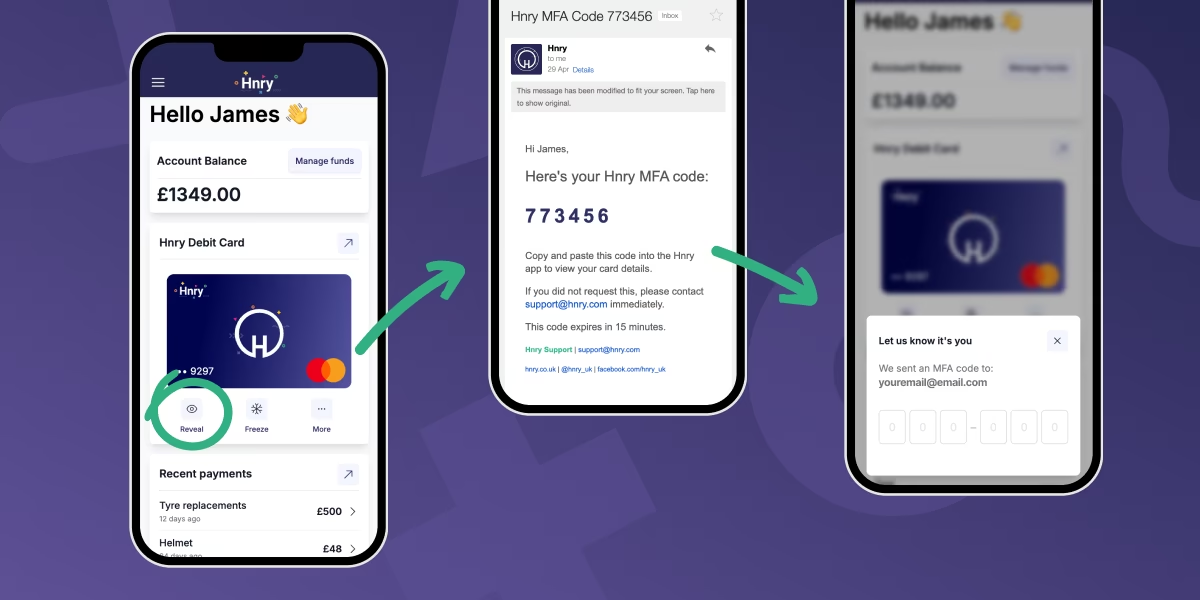

1. Accessing your Hnry Business Mastercard details

Your card details can be accessed from your Hnry Dashboard. In the “Hnry Business Mastercard” module, click on “Reveal”.

For security reasons, the app won’t give you your card details immediately – instead, you’ll be sent an email with a one-time code. Once you enter this code into the popup screen in the Hnry App, your card details will be revealed.

💡 To help keep your account secure, the Hnry team can’t access your card details. We’ll also never ask for them.

If you’re going to be using your card details a lot, you can add them to your Google Wallet, or Apple Wallet, or keep them somewhere else that’s secure – just remember to guard them with your life! Or at the very least, your dog. Definitely not a goldfish.

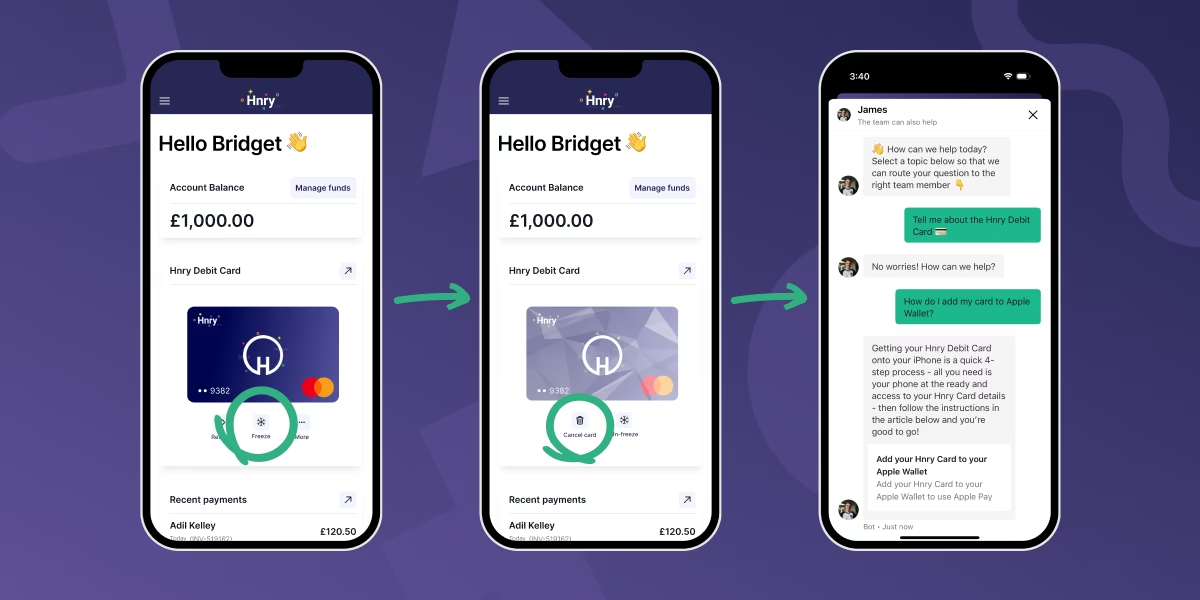

2. Add your card to Apple Wallet or Google Wallet

Once you have your details in hand, you can add the Hnry Business Mastercard to your Apple Wallet or Google Wallet on your phone.

For more information on how to do this, check out this Apple Wallet tutorial, or this Google Wallet tutorial.

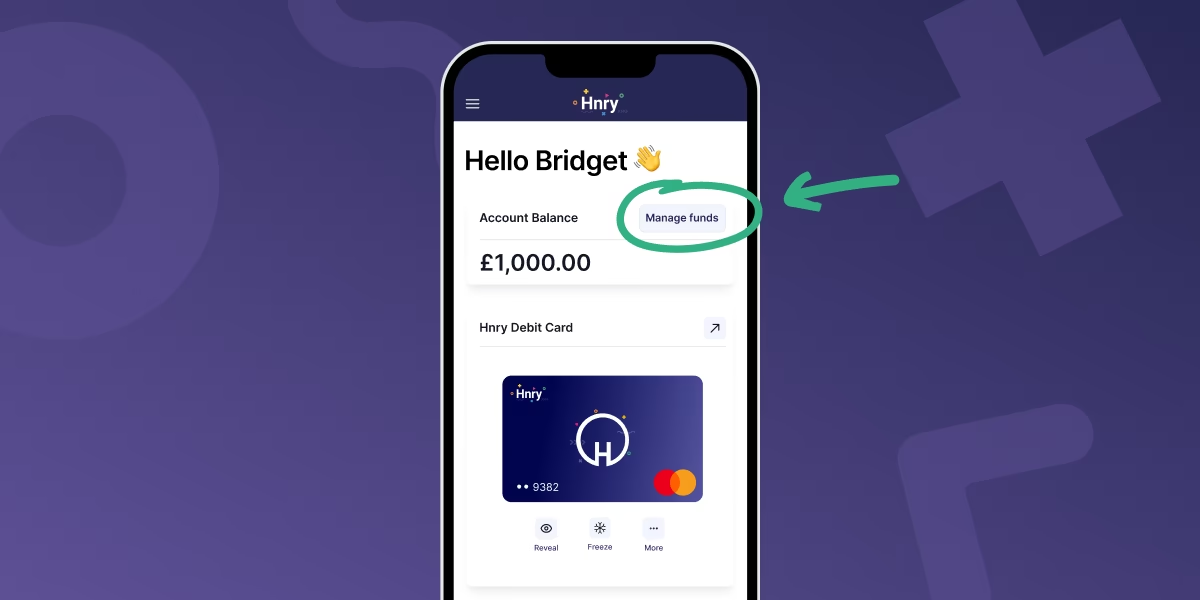

3. Top up your card

The Hnry Business Mastercard draws funds from your Hnry Account, not your personal bank account. This means that you have to top up your Hnry Business Mastercard before using it to make a purchase.

Usually, every time you get paid, we automatically calculate, deduct, and pay your taxes, and pass on the rest straight to your personal bank account. But if you want to use a Hnry Business Mastercard, you’ll need to make sure that there are funds left in your Hnry Account, available for you to use.

There are two main ways to do this (both accessed via the “Manage funds” button on the Dashboard).

1. Top up by bank transfer

To top up by bank transfer, you’ll need to transfer funds from your personal bank account to your Hnry Account.

💡 Funds need to be transferred from the personal bank account registered to your Hnry Account. Otherwise, transferred funds may be processed as a client payment!

You’ll need to:

- Include the reference “Card top up” (if you don’t, we may process the funds as income!)

- Make the payee name

- your first initial

- your last name

- and include “(via Hnry)” at the end

- Use your Hnry Account number as the bank account number

… and you’re done!

💡 Make your top ups even easier by saving these details as a payee in your banking app (including the reference, if you can). For extra points, you can set up an automatic payment so you’ll never be caught short!

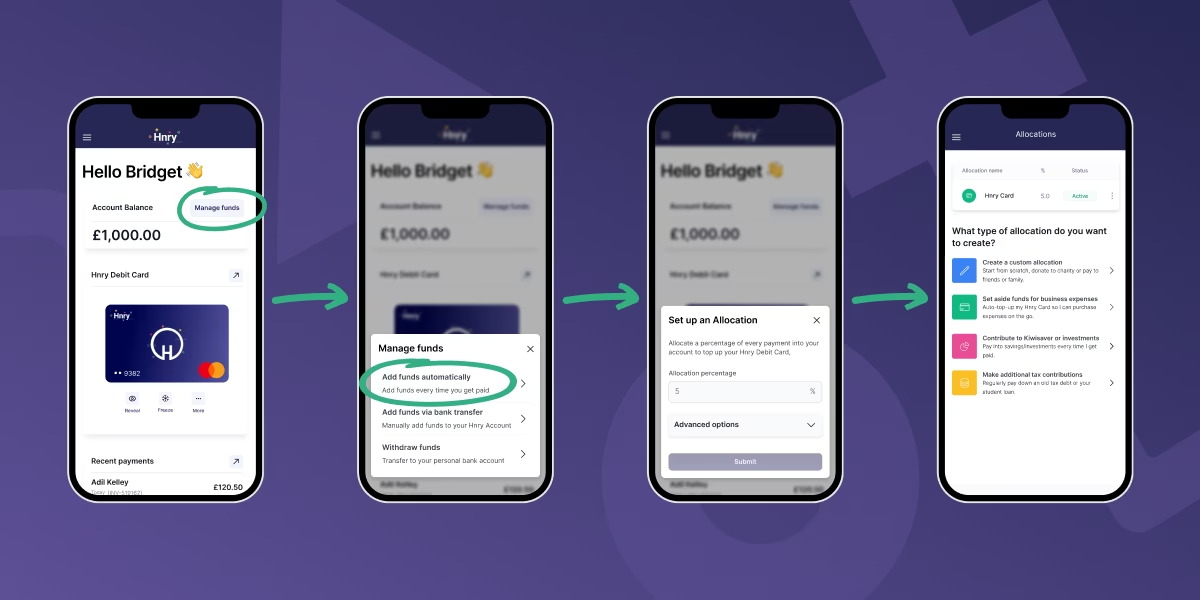

2. Top up by Allocation

You can also keep your card topped up at all times by creating an Allocation.

To create an Allocation, hit the “Manage funds” button on the Dashboard. Select the option to “Add funds automatically” and enter the percentage of each pay you want to send to your card.

For example, if you enter 5%, we will automatically send 5% of each pay you receive through your Hnry Account to your Hnry Business Mastercard.

Using your Hnry Business Mastercard

Using your Hnry Business Mastercard is as simple as tap, snap, and confirm.

Tap

When making a business purchase in store, use your Hnry Business Mastercard through your Apple Wallet or Google Wallet.

Simply tap your card against a contactless terminal the way you would any other virtual card, and you’re good to go!

(Or if you’re shopping online, tap your card details into an online payment page – whatever floats your boat.)

Snap

Snap a quick pic of your receipt, and upload it to the new expense that’s just been raised for your purchase in the Hnry App (under the “Expenses” tab).

Then – and this is important – never think about that receipt again.

Confirm

Add the final few details – like the cost of the purchase, and if it’s VAT inclusive – to your raised business expense, before hitting “Submit”.

That’s it. Expense raised. We’re all done here!

Other important Features

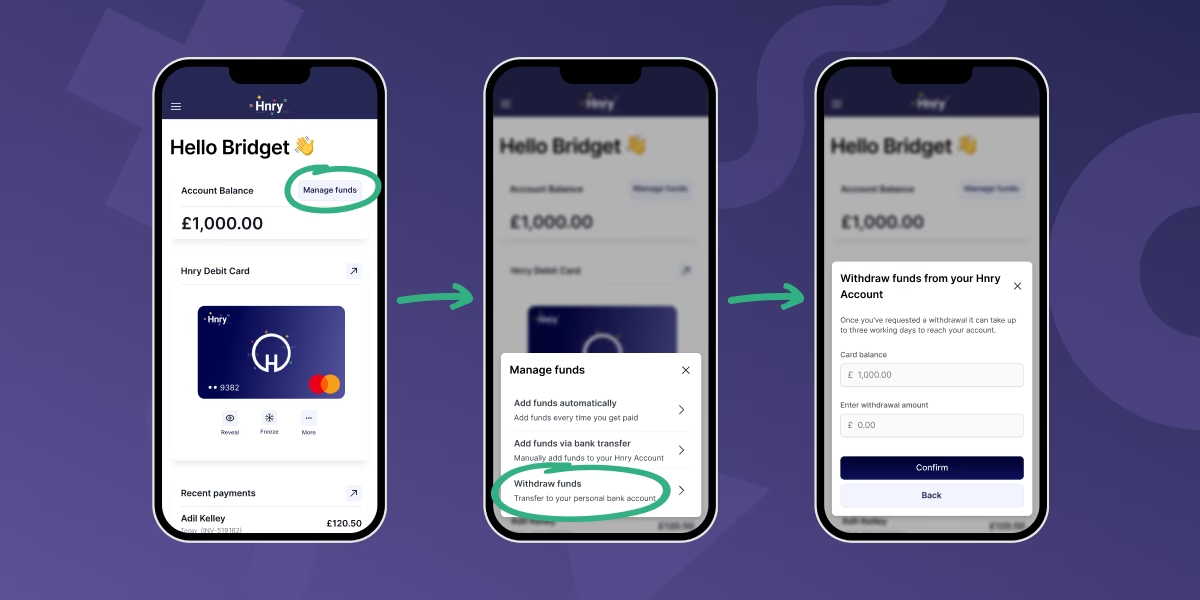

Withdraw Funds

If you need to access your Hnry Business Mastercard funds, for whatever reason, you can request to “Withdraw funds” via the Dashboard.

First, click the “Manage funds” button in the top right of the Dashboard.

Then select “Withdraw funds” from the options available. Enter the amount you want to withdraw, and it’ll be sent on its merry way to your personal account. Easy!

Freeze this card

If your card details are compromised, you can freeze your card to prevent it being used, just like any other debit card.

Simply click the “Freeze” button in the Hnry Business Mastercard module on the Dashboard.

Cancel card

And if it’s really not working out for you for whatever reason, you can cancel your Hnry Business Mastercard. This option becomes available once you’ve frozen your card.

Expense claims made easy with the Hnry Business Mastercard

We’re on a mission to make sure that sole traders never leave a tax deduction unclaimed again.

That’s why we created the Hnry Business Mastercard – to make purchasing, raising, and claiming business expenses easier than ever before.

With a Hnry Business Mastercard:

- Expenses are raised as you go

- Deductions are claimed as you go – so you get that sweet tax relief in real time

- No more pile of receipts stashed around the place

Best of all, there are no extra subscription/bank fees.

And don’t forget – on top of keeping track of all your business expenses, we automatically calculate, deduct, and pay your:

- Income tax

- VAT (if applicable)

- National Insurance Contributions

- Student loan repayments (if applicable)

- Private pension (optional)

Plus we sort your Self Assessment and your VAT returns – all for 1% +VAT of your self-employed income, capped at £600 +VAT annually.

So if you’re ready to give cards a whirl…

As with everything – conditions and exceptions apply. For more info, check out our Legal Page.

Share on: