What is Self Assessment? Great question! The short answer is that Self Assessment is the process by which HMRC collects income tax from people who don’t automatically have income tax deducted at source (like with employees, pension recipients etc).

For example, if you’re a freelancer, you’d use Self Assessment to tell HMRC about the income you’ve earned across the tax year, as well as any allowable expenses you’re claiming. They’ll then let you know how much you owe in income tax, National Insurance, student loan repayments (if applicable), and if you need to make payments on account (which we’ll get to later on).

There are two main ways to complete your Self Assessment – online, or by post. You’ll need to fill in the exact same information using either option, but the paper Self Assessment does require slightly more admin (beyond actually getting to the mailbox!), and involves different dates and deadlines.

Finally, for certain sole traders earning over £50,000 in qualifying income annually, there’s a new system you’ll need to be aware of going forward – Making Tax Digital (MTD). It involves keeping digital records of income and expenses, sending quarterly updates to HMRC, as well as submitting a tax return at the end of the tax year (we’ll talk through all this later on as well).

Phew! Alright, that was a lot of information in one go – but it is a big topic to cover! Let’s take it piece by piece:

- What is Self Assessment?

- Who has to complete a Self Assessment tax return?

- Registering for Self Assessment

- Key dates and deadlines

- Completing and filing your Self Assessment

- Keeping records for HMRC

- Paying Self Assessment tax

- Payments on account

- Self Assessment and Making Tax Digital

- Hnry does it all for you

What is Self Assessment?

Like we said earlier, Self Assessment is a system put in place by HMRC to collect income tax from earners who don’t automatically have it deducted at source.

Basically, if you’re earning an income that HMRC doesn’t know about through other channels, a Self Assessment tax return is how you tell them what you’ve been up to, so they can calculate how much you owe them.

Speaking of which, it’s also not just about income tax; Self Assessment calculations will also include National Insurance contributions you may owe, as well as your student loan repayments (if applicable).

Self Assessment applies to the tax year that’s just been, not the one you’re currently in. So if you’re filling in a Self Assessment tax return in late 2025, it would be for tax year 2024/25, not the current tax year 2025/26. Tax years begin on the 6th of April each year, and end on the 5th of April the next year (just to make things confusing).

Finally, while Self Assessment is the name of the system, what you’ll need to fill in and submit is a Self Assessment tax return. This is basically a form in which you specify things like:

- how much income you’ve earned in the most recent tax year

- the sources of any and all income streams

- the total you’re claiming in allowable expenses

- if you’re claiming any tax relief

According to the gov.uk website (specifically a page titled “Fascinating facts about Self Assessment”), it’s been 25 years since the launch of online Self Assessment tax returns, with 11.5 million+ filing online each year.

So if this is your first year using Self Assessment, welcome! You’re in great company.

Who has to complete a Self Assessment tax return?

Alright, so. You’ll need to register for Self Assessment, and complete a Self Assessment tax return if any of the following applied during the most recent tax year:

- You earned more than £1,000 in self-employed income (not counting any tax relief you’re eligible for)

- You were a partner in a business partnership

- You were required to pay Capital Gains Tax after selling or “disposing” of something that increased in value (eg. property, shares)

- You had to pay the High Income Child Benefit Charge (and haven’t arranged to pay it through your PAYE tax code).

Additionally, you may also need to use Self Assessment if you had any untaxed income, like:

- Money from a rental property

- Tips and commissions

- Income from savings, investments, and dividends

- Foreign income

If you’re not sure if any of the above applies to your specific situation, great news! Gov.uk has a handy tool you can use to figure it out. It’s completely informational and non-binding, and they won’t send any of your details to HMRC.

Registering for Self Assessment

Ok, you’ve decided that you’re required to submit a Self Assessment tax return. Sweet! First things first: you’ll need to register for Self Assessment.

The easiest and most common way to register for Self Assessment is through HMRC online services. You’ll need to create a Government Gateway account if you don’t already have one – but otherwise, the process is pretty simple and straightforward.

All you’ll need is fairly basic information, like your:

- National Insurance number

- Full name (and any previous legal names you were known by)

- Current address, and when you moved in

- Date of birth

- Gender

- Phone number

- Email address

You’ll also need to indicate whether you’ve registered for Self Assessment before, and answer a few quick questions about your business. Do all that, and Bob’s your uncle!

💡 If you need to complete a Self Assessment tax return for the previous tax year, you’ll need to register for Self Assessment by 5th October of the current tax year. For example, if you need to file a tax return for tax year 2024/25, you’ll need to register by 5th October 2025.

Once your registration has gone through, you’ll receive a Unique Taxpayer Reference – a UTR – via post (heads up: it might take a few weeks). You’ll need this when the time comes to file your Self Assessment tax return.

Key Self Assessment dates and deadlines

We’ve said it a few times now, but Self Assessment is best described as a process – there are a few different bits and bobs for you to sort throughout the tax year!

| Requirement | Deadline |

|---|---|

| Register for Self Assessment (if you haven’t before) | 5 October (after the end of the tax year) (If you register after this date, HMRC may charge a penalty. For more information, visit the gov.uk website). |

| Paper Self Assessment tax return due | 31 October |

| Online Self Assessment tax return due | 31 January |

| Tax payment deadline | 31 January |

| First payment on account due | 31 January |

| Second payment on account due | 31 July |

Got all that? Let’s do a quick walk through

Registering for Self Assessment:

You’ll need to register for Self Assessment before the 5th of October after the end of the tax year. So if you need to file a tax return for the 2024/25 tax year, you’d register for Self Assessment before the 5th of October 2025

⚠️ If you register after the deadline, HMRC may charge a penalty. For more information, visit the gov.uk website.

The good news is that you only need to register once – the first time you use the Self Assessment process. You’ll be able to sign in with your created credentials from then on.

Paper Self Assessment tax return due:

If you’re filing using a paper tax return, you’ll need to post it to your HMRC address so that it arrives before the 31 October deadline.

Paper tax returns are slightly more complicated in that they’re quite manual to use – you may have extra pages to fill, and may need to calculate your tax owed yourself – while the online system automatically generates these for you. According to HMRC, 97% of people file their Self Assessment tax returns online.

Once you send it in, HMRC will verify that your income tax and other calculations are correct, so you’ll send them the correct amount come the tax payment deadline (31 January).

If you plan to file by post, make sure to get started early so it’s all done and dusted on time!

Online Self Assessment tax return due

If you’re using the online system, your due date to complete your Self Assessment tax return is 31 January, the year after the tax year you’re filing for. So for the 2025/26 tax year, you’ll need to file your online tax return by 31 January 2027.

The online system is easier to use because it automatically generates the sections you need to complete based on your situation. It also calculates your income tax and other contributions and repayments for you, once you’ve submitted all your information.

Which is why the deadline for submitting your online tax return is the same as the due date for the –

Tax payment deadline

Any tax and other payments you owe HMRC will be due on the 31 January, the year after the completion of the relevant tax year.

There are a few different options available for paying your Self Assessment tax bill. You’ll need to make sure that your payment is cleared by the due date however – HMRC may charge interest and penalties on late payments.

First payment on account deadline

We’ll cover this in more detail in just a bit, but if you become eligible for payments on account, you’ll need to make your first payment by the 31st of January.

Second payment on account deadline

Your second payment on account is due on the 31st of July.

Completing and filing your Self Assessment

As long as you have all the information you need to hand, filling in a Self Assessment tax return should be fairly straightforward, if a little time-consuming.

Before you get started, it’ll be useful to have the following information to hand:

- Your UTR

- Your National Insurance number

- Records for your allowable expenses

- Any contributions to charity or pension funds that might be eligible for tax relief

- Any records (like a P60) that show how much you’ve already paid in income tax

Got all that? Brilliant! Now let’s get to the good stuff.

Section 1: Basic details

This bit’s pretty self-explanatory.

HMRC will need:

- Your full name

- Your address

- Your UTR number

- Your National Insurance number

- Your employer PAYE reference (if you have one)

Section 2: Sources of income

Here you’ll need to specify the different sources of income you’ll be declaring in this tax return.

💡 If you’re completing your tax return online, the relevant fields will automatically generate as part of your online form. If you’re completing a paper tax return, you may have to manually print out, complete, and include additional pages.

Sources of income could include:

- Employment – from a salaried job

- Self employment – for example, freelance income

- Partnerships – any partnership business income

- UK property – like rental income (income earned through property sales is considered capital gains)

- Foreign – money made overseas

- Trusts – or settlements, or any income from a deceased person’s estate

- Capital gains – income from selling or “disposing” of something that increased in value (eg. property, shares)

Section 3: Details of income

Now that you’ve specified the income sources you’ll be including, you’ll need to provide information for the last tax year around:

- How much you’ve earned

- Whether you’re claiming the trading allowance

- Your allowable expenses

- Any disallowable expenses

- Any capital allowances you’re claiming

- Any assets or liabilities your business holds

- Whether you’ve made a net profit or loss

- Which National Insurance contributions you’ll need to pay

If you’re completing a Self Assessment for more than just self-employed income, you may be required to provide different information for different sources of income. It should all be fairly self-explanatory, however – and if you get stuck, HMRC also provides helpful information on what each section of your Self Assessment tax return contains. Sweet!

Section 4: Tax relief

If you’re eligible for tax relief, whether that’s through private pension contributions, charitable giving, or the Blind Person’s Allowance (a tax relief available to registered blind individuals), here’s where you declare it.

Section 5: Student loan repayments

If you have an outstanding student loan, you’ll need to make repayments towards it through Self Assessment.

In this section, you’ll need to declare any repayments that an employer has already deducted from your salary income.

Section 6: High Income Child Benefit Charge

You’ll need to fill out this section if you:

- earned over £60,000 in income,

- got the Child Benefit, and

- were the higher earner in your household (if applicable).

Section 7: Marriage Allowance

This section only applies if you’re married or in a civil partnership.

If you or your spouse earned less than £12,570 across the tax year (eg. less than the Personal Allowance), you can transfer £1,260 of your Personal Allowance to your partner in order to lower their tax bill.

Section 8: Finishing your tax return

Here’s where you tie everything up in a nice neat bow.

You can use this section to tidy up any loose ends, including declaring if:

- You’ve paid too much in income tax

- You’ve paid too little in income tax

- You’ve received a tax refund or offset that needs to be considered

- You’re using a tax advisor (optional — but you’ll need to include their details).

Once you’re happy with your completed tax return, it’s time to sign on the dotted line. Nicely done!

Keeping records for HMRC

Once you’ve completed your Self Assessment tax return, don’t worry – the paperwork party isn’t over yet!

HMRC requires you to keep all records of business income and expenses, including any and all supporting documents – things like invoices, receipts, contracts, and vouchers. These can be physical or digital, whichever works best for you.

For freelancers, you’ll need to keep these documents for five years after the 31 January submission deadline – which is a long, long time to keep a shoebox full of receipts!

The good news is that if you’re a Hnry user, we automatically keep income and expense records for you. You can throw that shoebox away, and never think about it again.

Paying Self Assessment tax

Once you’ve completed your Self Assessment tax return, HMRC will notify you about any tax or other payments you may owe. If you filed a paper return, this could take a few weeks, but for online returns, it’s usually instant.

You’ll need to pay any outstanding income tax, National Insurance contributions, or student loan repayments by the 31 January deadline. Late payments could be subject to interest and/or penalties, depending on how late your payment is. The longer you wait to pay, the higher the charges incurred.

💡 Conversely, early tax payments could earn interest! For more information, check out the guidance on the gov.uk website.

If you’re worried about how much you might owe, it could be worth completing your tax return well before the 31 January deadline – that way you’ll have a little extra breathing room before you have to pay your bills.

Alternatively, we have a handy tax calculator that could help you estimate how much you’ll owe in income tax, National Insurance, and student loan repayments as a freelancer:

Freelancer tax calculator

Or better yet — let Hnry handle it all for you.

Hnry is a tax app and service built specifically for freelancers. For just 1% +VAT of your self-employed income (capped at £600 +VAT per year), we’ll automatically set aside everything you owe to HMRC, every time you get paid.

We’ll also sort your Self Assessment tax return for you – it’s all part of the service. Easy!

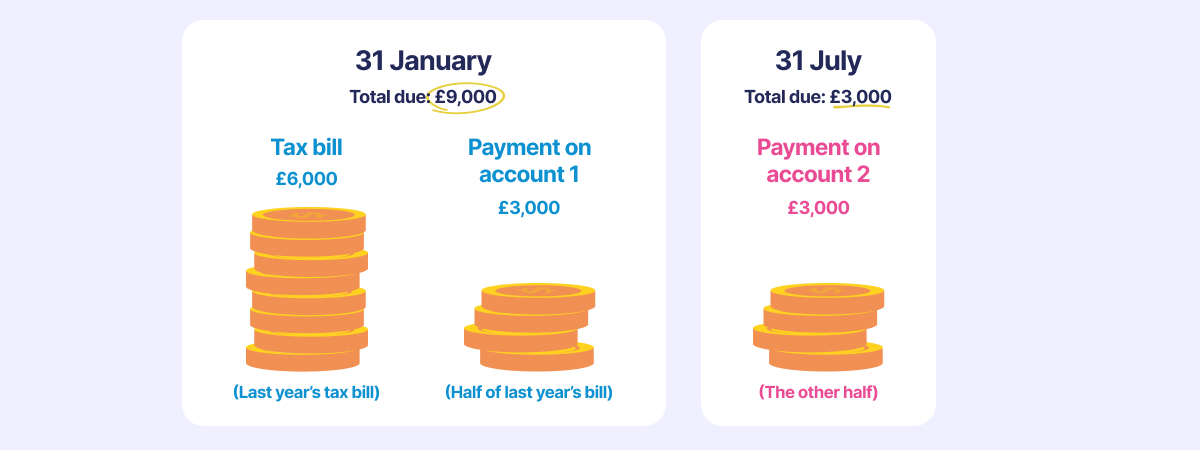

What are payments on account?

Payments on account are HMRC’s way of helping you avoid a single, massive tax bill at the 31 January deadline. It requires you to partially prepay next year’s tax bill in two separate payments. The first is due on the 31st of January, the second on the 31st of July.

💡This is in addition to the tax you owe on 31 January for the previous tax year – we can’t stress this enough!

If you’re required to make payments on account, HMRC will let you know through their Self Assessment tax calculations (after you submit your tax return). Each of the two payments is generally 50% of the previous tax year’s income tax bill (so excluding National Insurance contributions and student loan repayments).

Who needs to make payments on account?

If:

- your outstanding tax bill is for more than £1,000, and

- you paid less than 80% of your income tax bill outside of Self Assessment (eg. through your salaried job),

you’ll need to make payments on account for the current tax year.

The payments on account system is yet another reason why we recommend you complete your Self Assessment well ahead of time – there’s nothing worse than realising you owe more to HMRC than you perhaps accounted for (mind the pun!).

Self Assessment and Making Tax Digital

Ok, so. While all of the above information is still current and relevant, over the next few years HMRC will be shaking up the Self Assessment process in a big way.

Introducing: Making Tax Digital (MTD) – a new process for self-employed earners to provide their income information to HMRC. It’ll apply to everyone with an annual turnover over:

- £50,000 from 6 April 2026,

- £30,000 from 6 April 2027, and

- £20,000 from 6 April 2028.

Those earning below these thresholds will still need to declare their self-employed income through the old Self Assessment process.

What’s changing?

The short answer? A lot – according to HMRC, Making Tax Digital is the biggest change to the Self Assessment system since it was launched 30 years ago.

Basically, under Making Tax Digital, self-employed earners will be required to use MTD-compatible software to keep digital records for their income and expenses.

You’ll then need to use this software to send HMRC quarterly updates across the tax year.

Finally, once the tax year is over, you’ll need to submit your tax return using MTD-compatible software, rather than HMRC’s online portal.

When do you need to switch to Making Tax Digital?

Great question! MTD requirements are being rolled out for freelancers and sole traders in stages, depending on your level of turnover.

agree agree agree.

💡Turnover here means total sales revenue before deducting allowable expenses. So if you make £100 worth of sales, but spend £50 creating your products, your turnover will be the full £100 earned.

Freelancers earning £50,000 or more in annual turnover will need to start using MTD-compatible software from 6 April 2026.

Freelancers earning £30,000 or more in annual turnover will need to start using MTD-compatible software from 6 April 2027.

Those earning below these thresholds will continue using the existing Self Assessment process — at least for now. HMRC hasn’t yet confirmed when (or if) MTD will be extended to lower earners.

Hnry does it all for you

Whether you need help sorting your upcoming Self Assessment tax return, or you’re looking to get a head start on MTD-compatible software, Hnry has your back!

Hnry is an award-winning tax app and service, designed specifically for freelancers and other sole traders. For just 1% +VAT of your self-employed income, capped at £600 +VAT annually, we calculate, deduct, and pay all your tax bits and bobs for you, including:

- Income tax

- VAT (if applicable)

- National Insurance contributions

- Student loan repayments (if applicable)

We also complete your Self Assessment tax return on your behalf, and we’re MTD-compliant. Plus through our app, you get access to unlimited invoices, unlimited quotes, and your expenses managed by our local team of tax experts. Basically, we’re the all-in-one tax solution of your dreams (and we’re humble too!).

If all this sounds good to you, what are you waiting for? Join Hnry, and never think about tax again!

Share on: