Value Added Tax (VAT) is a consumption tax that’s charged on most goods and services in the UK.

It’s called a consumption tax because it’s charged on things we “consume” (figuratively as well as literally), rather than being charged on our personal income.

If you’ve ever really studied a receipt, say from a large, blue Swedish furniture store, you’d no doubt have noticed that extra amount of pounds at the bottom of your receipt marked “VAT”.

VAT is a flat tax charged on top of whatever you paid for your ironing board/frying pan/flatpack wardrobe. But it’s not profit kept by the retailer – instead, it’s collected by them on behalf of HMRC.

The rate at which VAT is charged depends on what’s being sold. Most goods/services are eligible for the standard VAT rate of 20%, but some are subject to a reduced rate of 5%, or are zero rated, meaning VAT is charged at 0%. A small number of products and services are exempt entirely.

(Don’t worry – we’ll cover all this in more detail in just a minute.)

If you’re a freelancer, you may have wondered if you’re supposed to be charging VAT too. And if so, how do you do it? Why do you do it? Do you have to raise your prices to cover it? What if your clients are based overseas, do they still have to pay VAT?

All great questions. Luckily, we’ve got the answers. Let’s dig in.

1. Introduction to VAT

What is VAT?

Like we mentioned earlier, VAT is a consumption tax charged on things we consume. We’re not just talking about food and drink here though; a consumption tax applies to most resources (goods and services) that can be used up, or “consumed”.

VAT is also a flat tax (unlike income tax, which is a progressive tax system). This means that the VAT rate charged – usually 20% – doesn’t change, no matter how much you earn, or the price of what you’re buying.

Not everything you can purchase or sell is subject to the standard 20% rate of VAT, however. The government charges VAT at a reduced rate of 5% for some goods and services – for example, children’s car seats, and energy for your home.

Some products and services are eligible for zero-rated VAT – VAT charged at 0% – like most food and children’s clothing.

Finally, there are products and services which are VAT exempt, meaning you wouldn’t charge VAT on them at all. This includes things like financial services, healthcare, and certain charity events.

If you make £90,000 or more in taxable turnover, you’re required to register for and charge VAT (we’ll cover this in a sec). This means that you charge VAT on top of your regular fees, which you record and pay to HMRC when you file your next VAT return.

💡 Taxable turnover is the total value of everything you sell, minus anything that is VAT exempt or “out of scope”.

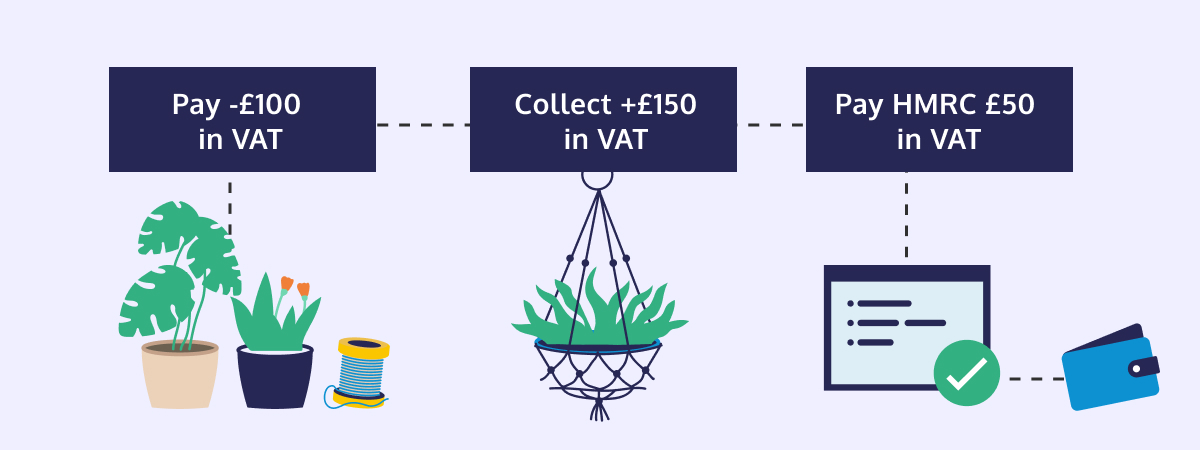

If you’re registered for VAT, whenever you buy goods and services for your business that have VAT added, you can subtract the cost of the VAT you’ve paid from the VAT you need to pay HMRC. If you’ve paid more VAT than you’ve collected, you may be eligible for a VAT repayment (don’t worry – we’ll cover this in a bit too.)

Do I have to register for/charge VAT?

Short answer

- If you’re registered for VAT, you must charge and collect VAT.

- Freelancers, sole traders, and businesses whose taxable turnover has gone over £90,000 in the last 12 months, or expect to earn over £90,000 in the next 30 days alone, have to register for VAT.

Long answer

If you make less than £90,000 in taxable turnover

If you’ve made less than £90,000 in taxable turnover in the last 12 months, and don’t expect to make more than £90,000 in the next 30 days, you don’t have to register for VAT. You can if you want to, but like with any business decision, there are pros and cons.

The main benefit of being VAT registered is that you can claim back VAT on your business expenses (subject to restrictions/exemptions). If you pay more in VAT when buying supplies for your business than you charge your clients, you are eligible for a VAT repayment.

If you’re below the threshold, you may decide that registering for VAT isn’t worth it, as it can be a lot of extra paperwork for little reward. And as freelancers, ain’t nobody got time for that.

There are a few cases, however, in which you may consider registering for VAT while you’re still under the threshold. If you buy a lot of supplies in bulk for your business, for example, then being able to claim the VAT back can help you better manage your cash flow. Similarly, it might make it easier to deal with your suppliers.

Whether or not you register for VAT is up to you, but think of it as a calculated business decision. If you’re under the threshold, you need to decide if the benefits outweigh the cons.

Registering for VAT: pros and cons

| Pros | Cons |

|---|---|

|

|

If you make £90,000+ in taxable turnover

If you’re a freelancer, and you’ve earned £90,000+ in taxable turnover in the last 12 months, or you’ll earn £90,000+ in taxable turnover in the next 30 days (good for you!), you are required to register for VAT within the next 30 days. Once HMRC confirms your registration, you’ll need to start collecting VAT from your clients.

(If you’re late registering for VAT once eligible, you may be subject to penalties, interest, or even backpaying VAT from your effective date of registration.)

Yep, this is all still the case if you aren’t incorporated as a company – it’s not necessary for VAT registration. You will need a Unique Taxpayer Reference or a National Insurance number to register for VAT, though.

If you’re an employee with a freelance side hustle, you only have to register for VAT once your side-hustle income reaches £90,000 in a 12-month period. Your combined income doesn’t count towards the threshold.

It’s also important to note that the £90,000 threshold doesn’t apply to a single financial year, but rather any 12 months in succession.

For example, if you make £90,000 between November of one year and October the next, you’re required to register for and start charging VAT – even though that 12 month period is split between two financial years.

Tl;dr: you need to register for VAT as soon as your freelancer earnings in any 12-month period reaches £90,000. If you’re already making over the £90,000 threshold, you need to register for VAT asap!

Reduced, zero-rated, and exempt products and services

Like we mentioned earlier, certain products and services are eligible for a reduced rate of 5%, or are zero-rated meaning you charge VAT at 0%. If your products or services fall within this category, you’ll need to charge VAT accordingly.

Yes, this does mean that you have to record a VAT amount of £0 on your invoices for zero-rated products!

Then, there are goods and services that are exempt from VAT, meaning you can’t charge VAT on these at all. If these products/services are all you sell, you’re not allowed to register for VAT, or claim VAT back on related business expenses – these sales don’t count towards the £90,000 VAT threshold.

So, to recap:

| Category | Rate charged | Used for |

|---|---|---|

| Standard rate | 20% | Most goods and services |

| Reduced rate | 5% | Some goods/services: eg. children’s car seats, home energy |

| Zero rate | 0% | Some goods/services: eg. most food, children’s clothing.💡 VAT is still charged on zero-rated sales, just at 0%. These sales will count towards your taxable turnover, and you’ll be eligible to reclaim VAT once registered. |

| Exempt | N/A | Some goods/services: eg. financial services, healthcare, certain charity events💡No VAT is charged on exempt sales. Because of this, these sales will not count towards your taxable turnover. You also won’t be able to reclaim VAT on associated business expenses. |

This isn’t a full list, and the rules can get pretty specific — so it’s important to check how your exact products or services are treated for VAT. There are strict rules about specific items and services, so you shouldn’t make assumptions about whether or not yours fall within the reduced, zero-rated, or VAT exempt categories.

The good news is that you can find all the info you need on the UK government website – including handy links to the corresponding VAT notice for each product/service category. Talk about relaxing weekend reading!

2. Registering for VAT

It’s a common misconception that registering as a freelancer, or filing a tax return, automatically registers you for VAT. This isn’t the case.

If you haven’t specifically registered for VAT, you are not registered for VAT. You won’t have to charge VAT, and you won’t be eligible for VAT repayments.

If you HAVE registered for VAT, even if you aren’t required to, you must collect and pay VAT. The amount of VAT you’ll need to pay is based on the sales you’ve made during that accounting period. You need to make sure that you collect VAT from your clients. If you don’t, you’ll have to go back and ask your clients to retrospectively pay VAT, or pay your VAT bill out of pocket (!!!).

💡 If you’re VAT registered, you’ll also have to create “VAT invoices’’, which have to meet specific requirements. For more information, check out our ultimate guide to invoicing.

🙋 If you’re a Hnry user, we’ll let you know when you start approaching the £90,000 VAT threshold. Plus, we’ll calculate and file all your VAT returns for you. See how it works!

Tl;dr

💡 Unless you’ve registered yourself for VAT, you are not VAT registered

💡 If you are VAT registered, you must charge and collect VAT

💡 If your taxable turnover goes over £90,000 in any 12-month period, or you expect to make more than £90,000+ in the next 30 days, you will need to register for VAT.

Accounting periods

When you register for VAT, you decide how often you would like to submit a VAT return. This timeframe then becomes your accounting period.

There are three options you can choose from:

- Monthly

- Quarterly (every three months)

- The default option, unless you specify otherwise

- Annually (once a year)

- Harder to keep track of, but less paperwork overall

💡 The default is quarterly returns, which tend to be the most easy to manage, but you can apply to submit monthly or annual returns instead.

You’ll also decide whether you’ll pay on a “cash” basis or an “invoice” (accrual) basis (FYI at Hnry, we work on a cash basis).

Sometimes, you may find that within an accounting period, you’ve paid more in VAT than you have collected. In these instances, you would receive a VAT repayment from HMRC.

Cash vs. Invoice (accruals) basis

When you register for VAT, you’ll also need to decide whether to register on a “cash” or “accrual” (non-cash) basis. Basically, will you pay VAT when you’ve invoiced (accrual)? Or will you pay VAT after you’ve received the payment of your invoice (cash)?

It’s an important choice, and will affect your business’ cash flow. Let’s break down the pros and cons.

💡 Most small businesses can choose either method, but the cash basis is only available if your VAT taxable turnover is under £1.35 million.

Cash basis

When you register for VAT on a cash basis (known as the Cash Accounting Scheme), the date that you ‘recognise’ the VAT on your sales will be the date that you receive the money.

For example, if you send someone an invoice on the 20th of March, and they pay you (including VAT) on the 20th of April, you wouldn’t declare it in your VAT return until you’ve been paid – even if your accounting period ends at the end of March.

Instead, you’d count it as part of the next accounting period, at which point you’d send the VAT to HMRC.

Invoice (accrual) basis

When you register for VAT on an invoice basis, the date that you “recognise” the VAT on your sales will be the date on the invoice to your client.

Using the same example, you send an invoice on the 20th of March, and they pay it on the 20th of April. On an accruals basis, you’d have to declare the VAT in the period the invoice was dated, and pay the VAT to HMRC – even if you haven’t received the payment from your client yet.

There are some benefits to an invoice schedule – for example, you can claim VAT you’ve received an invoice for, even if you haven’t paid it yet – but for freelancers, it can get stressful. Especially if your clients are notoriously late in paying their invoices.

There may also be more admin involved in tracking invoices and due dates. Just a heads-up.

Cancelling your VAT registration

If your expected taxable turnover for the next 12 months drops below £88,000, or if you registered for VAT while under the earnings threshold, and you decide that you no longer want to be VAT registered, you may be able to cancel your VAT registration.

The process is fairly straightforward. You can do it online through the gov.uk website.

If you’re not eligible for online cancellation, you’ll need to cancel your VAT account via post.

Once your VAT registration is cancelled, HMRC will send you confirmation. You’ll also need to:

- submit a final VAT return,

- pay any outstanding VAT due, and

- keep your VAT records for an additional six years.

3. Charging and Collecting VAT

If you’ve decided to register for VAT, the next step is to actually collect VAT from your customers. Unless your products/services qualify for a different VAT rate, this means adding an additional 20% to your prices.

It can be a bit nerve-wracking to suddenly “raise your prices” by 20%. But customers are used to paying VAT, and should understand that they’re not paying you extra – they’re paying tax to HMRC.

Clients who are VAT registered should be indifferent to you charging them VAT, as they can claim it back in their own VAT returns. But if you’re worried about the price jump, you could preempt the change with a quick email to your regular clients.

You can also specify in your quotes whether or not your prices are VAT inclusive or exclusive. The way you position it could make a real difference, depending on your customer base.

💡 If you work with other VAT-registered businesses, it’s common to quote VAT-exclusive prices.

What we don’t recommend doing is absorbing the cost yourself – eg. not adding 20% VAT to your prices, and paying your VAT bill out of your own pocket. While the cost for your customers won’t change, you’ll effectively be taking a pay cut. And that will stack up over time in terms of revenue lost – especially if it means you have less left over to invest in your business.

Remember: VAT is a tax charged to your customers, not you!

Calculating VAT

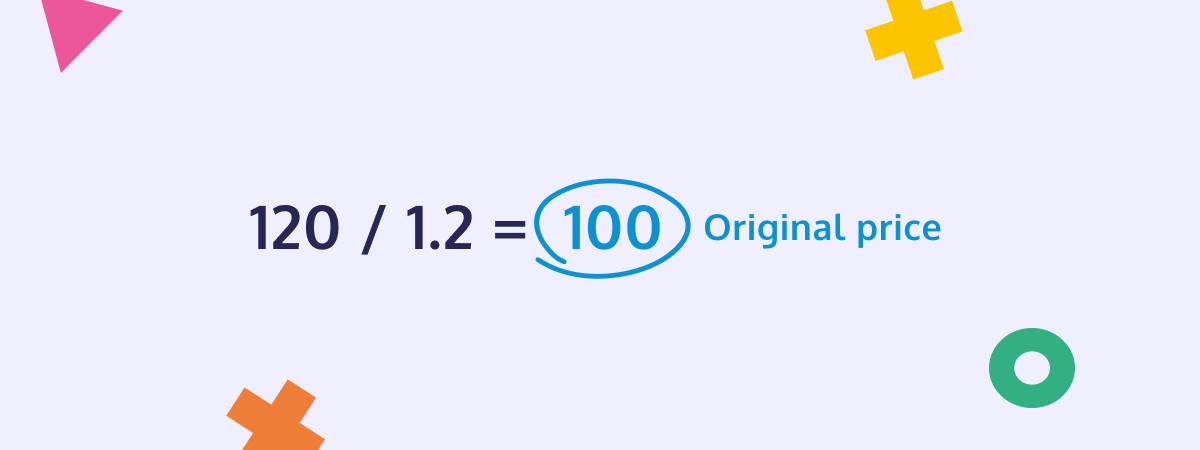

VAT is a flat tax of 20% added to most goods and services sold by someone who is registered for VAT. The easiest way to add VAT is to take the original price, and multiply it by 1.2:

The equation to subtract VAT is the same, just reversed. Take the original price, and divide that by 1.2:

VAT-inclusive vs VAT-exclusive pricing

Whether a price is VAT inclusive, or will then have VAT added on, makes a real difference to the final cost.

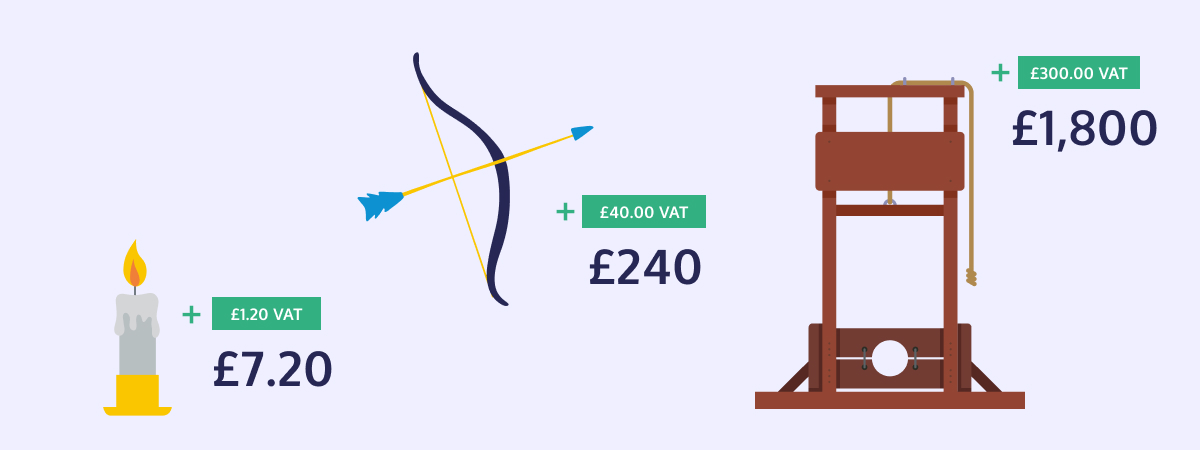

Say you go to a medieval fair and buy a beeswax candle for £6, a longbow for £200, and a life-sized, non-functional guillotine replica for £1,500. You know, to decorate your living room.

If the price of each item was already VAT inclusive, it means that 20% of the original price has already been calculated and added to the final cost:

However, if each item still needed VAT to be added on, the price would increase by 20%:

Moral of the story: Most vendors will let you know beforehand if they charge VAT, but if you’re not sure, it’s worth it to check. You should also specify if your rates as a sole trader are VAT inclusive or exclusive, just so there are no nasty surprises further down the track.

Also, you may want to ok a life-sized guillotine with your family before you bring it home and put it next to the TV. Just a thought.

VAT Calculator

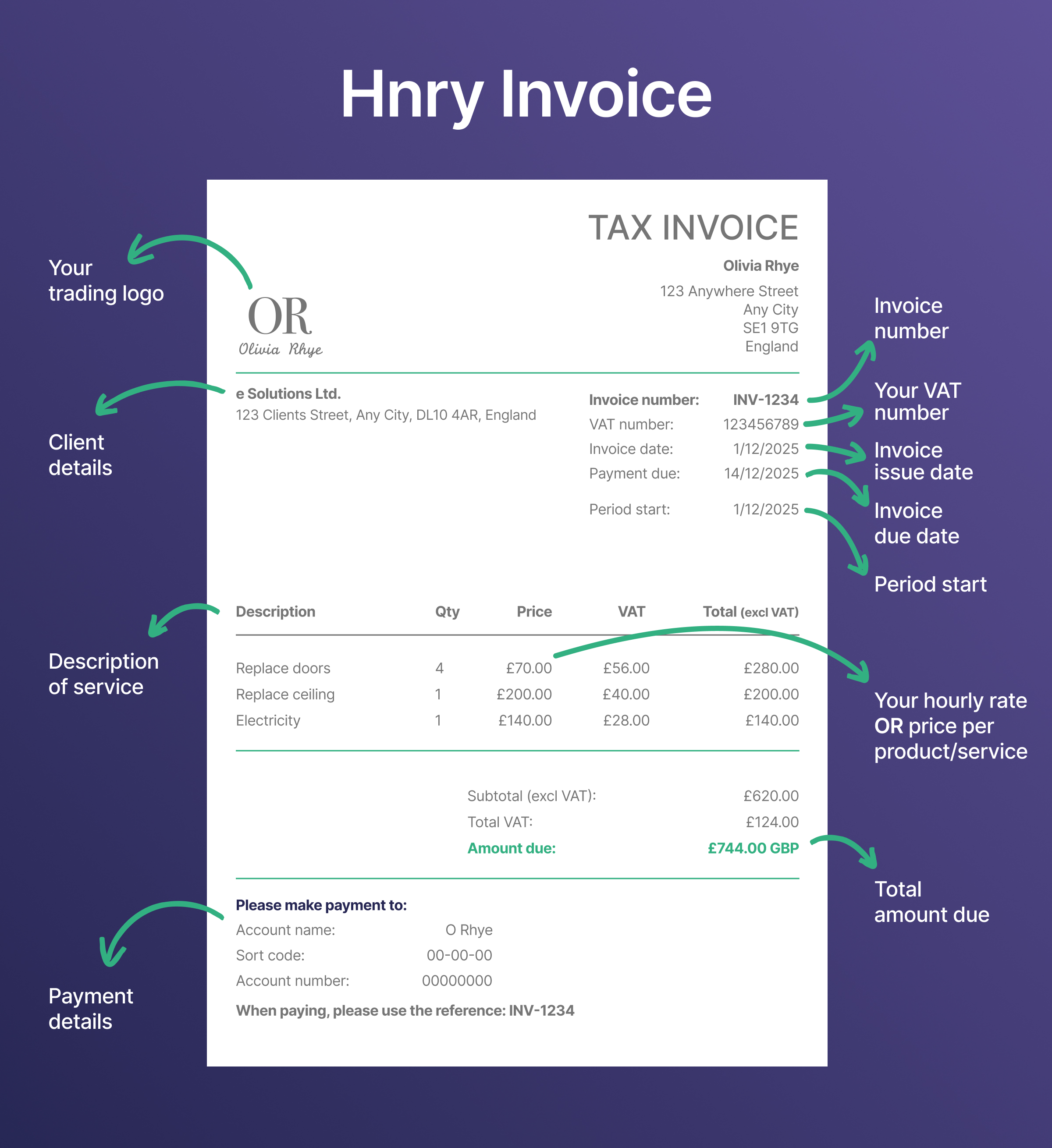

Recording VAT on Invoices

If you’re VAT registered, you’re required to provide “VAT invoices”, which are slightly different from regular invoices. In certain situations, you’re allowed to provide a “simplified VAT invoice”, or a “modified VAT invoice”.

💡 If your client requests a full VAT invoice, you must provide one – regardless of their VAT status.

💡 If your sale includes both VAT-exempt and taxable supplies, you can include them all on the same VAT invoice — just make sure that when specifying VAT rates, you clearly mark the exempt supplies as “exempt” or “0% (exempt)” so it’s clear they’re not subject to VAT.

Full VAT invoice

If you’re VAT registered, you’ll need to provide a full VAT invoice if:

- Your client is also VAT registered, or

- Your client requests a full VAT invoice

A VAT invoice must include the following information:

- a unique, sequential invoice number

- the time of supply (when you provide goods/services to your client)

- the date of issue of the invoice (where different to the time of supply)

- your name, address, and VAT registration number

- the name and address of your client

- a description of the goods or services sold

- the quantity of the goods or the extent of the services

- the unit price for each good/service

- the amount payable excluding VAT for each item

- the rate of VAT for each good/service

- subtotal amount (excluding VAT)

- any cash discount terms (if offered)

- the total VAT charged

💡 While HMRC doesn’t explicitly require it, including the gross total of the sale including VAT is quite common, and extremely helpful for your clients!

The good news is that once you’ve set up your invoicing system, it’ll be rinse-and-repeat for each invoice from then on!

Simplified VAT invoice

Simplified VAT invoices are just that – a more simple version of a full VAT invoice. They’re slightly easier to put together, given that they don’t have to include as much information.

You can provide a simplified VAT invoice if:

- The sale is £250 or less (including VAT), and

- You’re selling to consumers (non-VAT registered customers) who don’t request a full invoice, or

- You’re a retail business, and your client hasn’t requested a VAT invoice

For simplified VAT invoices, you’ll need to record:

- a unique, sequential invoice number

- your name, address and VAT registration number

- the time of supply (when you provide goods/services to your client),

- a description of the goods or services sold,

For each applicable VAT rate, you’ll need to include:

- the VAT rate applied

- the total amount payable (including VAT)

Modified VAT invoice

Modified VAT invoices are basically full invoices, but with VAT inclusive pricing, instead of exclusive.

You can provide a modified VAT invoice if:

- You’re a retail business, and

- The total sale is over £250 (including VAT), and

- You have permission from your client to provide a modified invoice

For a modified invoice, you’ll need:

- a unique, sequential invoice number

- the time of supply (when you provide goods/services to your client)

- the date of issue of the invoice (where different to the time of supply)

- your name, address, and VAT registration number

- the name and address of your client

- a description of the goods or services sold

- the quantity of the goods or the extent of the services

- the unit price for each good/service (including VAT)

- the amount payable for each item (including VAT)

- the rate of VAT for each good/service

- any cash discount terms (if offered)

- the total VAT charged

- the gross total amount, including VAT

Phew!

Hnry Invoices

Speaking of which, have you given Hnry Invoices ago? You can create clean, clear invoices in just a few clicks. Plus if you’re VAT registered, we automatically add VAT on to all your prices – no maths required on your part!

📖 Keen to try Hnry’s Invoicing feature? Check it out!

We’ll also claim back any VAT repayments you’re eligible for when we submit your VAT returns, so you can forget about all that and get on with the fun stuff.

Charging/Paying UK VAT overseas

Charging VAT on overseas sales

Whether or not you need to charge VAT when selling your stuff overseas depends on what’s called the “place of supply”.

The place of supply is basically where your product/service is treated as being supplied. Whether that’s the UK or elsewhere depends on whether or not your client is a business, or a consumer, and what goods/services you’re providing:

- If your client is a business, the place of supply will be wherever in the world they’re based (with some exceptions).

- If your client is a consumer, the place of supply will be where you’re based – so in this case, the UK (again with some exceptions).

In general, unless you know that your goods/services will be wholly for private use, you can presume your client is a business for place of supply purposes if they provide you with a VAT number (you’ll need to hold on to this as proof).

If the place of supply is the UK, you’ll need to charge VAT at the standard rate of 20% (if applicable to your goods/services). If the place of supply is outside the UK, it’s considered “out of scope” for VAT purposes. You can zero rate these sales, meaning you charge VAT at a rate of 0%.

In this situation, you’ll still need to record VAT of £0.00 in your invoice and include these sales in your regular VAT returns.

Right, you got all that?

| Client type | Place of supply | VAT rate |

|---|---|---|

| Business | Client’s location (outside the UK)* | 0% |

| Consumer | Your location (UK)* | 20% |

Exceptions apply for certain goods and services. For more information, visit the gov.uk website

💡 If you’re based within Great Britain, the above rules apply if your client is based outside the UK. If you’re operating in Northern Ireland, the above rules apply if your client is based outside the UK and the EU (due to the Northern Ireland Protocol). For more information on how VAT works between Northern Ireland and the EU, visit the gov.uk website

💡 If the product you’re supplying to your client is zero rated, you have to note the £0 of VAT that was “charged”. This means that your client pays nothing in VAT, but you still have to record these sales in your regular VAT returns (in box 6, to be specific). Yep, we know it’s confusing – it’s just one of those things.

As you can see, VAT rules and regulations can get quite complicated – so if you’re in doubt, it’s always a good idea to double check which rules apply with a tax expert (like us! Hi! We’re Hnry).

Paying VAT on overseas purchases

If you’re a VAT-registered business, you’ll need to account for UK VAT on overseas purchases using either the reverse charge rule, or Postponed VAT Accounting (PVA).

- For the purchase of most services, or goods worth less than £135, you’ll generally need to use the reverse charge rule, provided the supplier hasn’t already charged UK VAT at the point of sale.

- The £135 threshold only applies if it’s a business-to-business sale, and you’ve provided the seller with your VAT registration number. Otherwise, UK VAT may be charged at the point of sale.

- For the purchase of goods over £135, PVA gives you the option to account for import VAT on your VAT return, rather than paying on import.

The reverse charge rule (services, and goods <£135)

Basically, instead of your supplier charging you UK VAT, you’ll need to credit your VAT account with the appropriate amount of UK VAT for the purchase, before debiting your VAT account by the same amount. In general, this should cancel itself out, meaning you’ll actually pay £0 in UK VAT.

Let’s break down that process:

- Convert the cost of your supplies into pound sterling (if needed)

- Calculate the correct amount of UK VAT that would be owed on this purchase

- Credit your VAT account with the amount of VAT due (as if you had supplied the goods)

- Debit your VAT account with that same amount of VAT (as if you had then paid that VAT)

This will all need to be recorded in your regular VAT return, like all other VAT you collect and pay.

Postponed VAT Accounting (goods >£135)

Generally, for goods worth more than £135 in total, UK VAT will be collected at the point of import (known as “import VAT”).

Import VAT is calculated by first converting the purchase price into sterling, plus the cost of transport, postage and packing, insurance and any duty that may be payable, then adding VAT at the applicable rate.

VAT-registered businesses can use Postponed VAT Accounting to not pay import VAT at this point – instead, you can record import VAT in your regular VAT returns similarly to how you would using the reverse charge rule:

- Convert the cost of the goods plus any associated costs (packing, shipping, transport, duty etc) into pounds sterling

- Calculate the correct amount of UK VAT to apply to the total

- Note that you’ll be using PVA in your import declaration

- In your next VAT return, credit your VAT account with the amount of VAT due (as if you had supplied the goods)

- Debit your VAT account with that same amount of VAT (as if you had then paid that VAT)

- Include the net value of your imports in Box 7 of your VAT return

Tada! Which actually brings us nicely to –

4. VAT returns

What is a VAT return?

When you’re VAT registered, you are required to submit VAT returns on a regular basis. As of 1st April 2022, it’s been mandatory for all VAT-registered businesses to use Making Tax Digital-compliant software to submit their VAT returns.

(While we’re here, Hnry is Making Tax Digital compliant! We sort all things VAT on your behalf, including calculating, deducting, and paying VAT to HMRC, and preparing all your VAT returns as and when they’re due. Learn more.)

A VAT return is essentially a declaration to the HMRC of:

- the total VAT you’ve collected on your sales/income; and

- the total VAT you’ve paid while making business purchases.

What you then pay to HMRC is the balance between the two figures:

💡 Hold any VAT you collect separately from the rest of your income. That way, you’ll always have the right amount on hand to send to HMRC. If not, you’ll be hit with fines and penalties. If you’re a Hnry user, we do all this on your behalf!

Whenever an accounting period is complete, you’ll need to fill out a VAT return. But hang on, we’re getting ahead of ourselves – what exactly do you need to complete a VAT return?

Filling in a VAT return

Outside of the usual necessary details (name, VAT registration number etc), your actual VAT return basically consists of nine separate boxes.

💡 Boxes 2, 8, and 9 relate specifically to businesses operating in Northern Ireland, trading with countries in the EU as per the Northern Ireland Protocol. For more information, visit the UK government website.

Box 1: VAT due on sales and other outputs

This generally means VAT that you’ve charged and collected during this period.

Box 2: VAT due on acquisitions of goods made in Northern Ireland from EU member states

Due to the slightly different rules for Northern Ireland, VAT on any goods purchased in the EU if you’re based in Northern Ireland needs to be listed here separately.

Box 3: Total VAT due The sum of boxes 1 and 2.

Box 4: VAT reclaimed in the period on purchases and other inputs The amount of VAT you’ve paid on eligible business expenses.

Box 5: Net VAT to pay to HMRC or reclaim Calculate the difference between box 3 and box 4 — this amount is either payable to HMRC (if box 3 is larger) or reclaimable from HMRC (if box 4 is larger).

Box 6: Total value of sales and all other outputs, excluding any VAT Basically what it says on the tin – the value of all sales made, excluding any VAT charged on top.

Box 7: Total value of purchases and all other inputs excluding any VAT The total of all your business purchases and expenses, including any imports, acquisitions of goods in Northern Ireland from EU countries (box 9), or reverse charge transactions, excluding VAT.

Box 8: Total value of all supplies of goods and related costs, excluding any VAT, to EU member states For supplies made from Northern Ireland to any EU country, excluding VAT.

Box 9: Total value of all acquisitions of goods and related costs, excluding any VAT, from EU member states For purchases made from an EU country, if you’re based in Northern Ireland, excluding VAT.

If you have all the numbers to hand, filling out a VAT return can be straightforward. Or you could save a lot of time by leaving all the admin and the numbers to Hnry – seriously, we’ve got your back.

Keeping VAT records

Alongside submitting your VAT returns, you’ll also need to keep records of all VAT-related activity for HMRC for at least six years.

This includes, amongst other things:

- all your sales and purchases, including zero-rated, reduced-rate, and VAT-exempt items

- copies of all invoices you issue

- all invoices you receive (original or electronic copies)

- self-billing agreements (where the customer prepares the invoice)

- the name, address and VAT number of any self-billing suppliers

- debit or credit notes

- any goods you give away or take from stock for your private use

You’ll also need to keep general business records, like bank statements, cash books, cheque stubs and the like.

You’ll also need to keep certain digital records, as per the Making Tax Digital rules. Things like:

- the VAT charged on goods and services you sell

- the VAT incurred on goods and services you purchase

- the ‘time of supply’ and ‘value of supply’ (excluding VAT) for everything you buy and sell

- any adjustments you make to a return

- reverse charge transactions

For more on VAT records you’ll need to keep, visit the UK government website.

The good news is that Hnry automatically does all this for you. We’re fully Making Tax Digital compliant, and we sort all your VAT-related admin for you any time anything is due. It’s all part of our service!

When are VAT returns due?

For monthly and quarterly accounting periods, VAT returns and payments are due one calendar month and seven days after the accounting period ends.

If you submit your VAT returns quarterly for example, and your accounting period is from the 1st of January to the 31st of March, your VAT return will be due on the 7th of May.

For the Annual Accounting Scheme, your VAT return and final payment will be due two months after the accounting period has ended. However, you’ll also need to make advanced payments throughout the year – either:

- nine monthly instalments of 10% starting in month four, or

- three quarterly instalments of 25%, paying in months four, seven, and ten.

It’s a good idea to make a note of your VAT due dates and note them in your calendar. If you submit late, you may end up incurring fines and penalties.

Alternatively, you could use Hnry. For just 1% +VAT of your freelance income (capped at £600 +VAT a year), Hnry will calculate, deduct, and pay all your taxes for you. This includes submitting ALL YOUR VAT RETURNS! Whoohoo!

5. Tl;dr: VAT Overview

Ok, we know that that’s a lot of information. To help it all stick, here are the quick takeaways:

- VAT is a flat-rate tax of 20% charged on most goods and services (some items have different rates or are exempt).

- If you’re a sole trader, and your taxable turnover is below £90,000 in a 12-month period, registering for VAT is optional.

- If you haven’t registered for VAT, you’re not registered for VAT. It’s not an automatic thing.

- You can be registered for VAT as an individual sole trader – you don’t need to register a company.

- You can’t charge VAT unless you’re registered for VAT. If you’re registered for VAT, you’ll need to charge VAT on your sales (or get caught out by HMRC).

- If you register for VAT partway through the year, you start charging VAT from then on – you don’t have to backpay VAT.

- VAT returns are filed on a monthly, quarterly or annual basis.

Hnry will do it all for you. No, seriously.

You can read a 6,000+-word article on VAT – or you can let us do it all for you instead.

(If you’ve made it this far though, we’re seriously impressed. Nerd.)

For just 1% +VAT of your self-employed income, capped at £600 +VAT a year, Hnry will calculate and pay all your taxes, levies and whatnot for you, including:

- Income tax

- VAT

- National Insurance contributions

- Student loan repayments

- Private pension contributions (optional)

We also file your income tax and VAT returns for you, at no added cost. AND we handle all your financial admin, like:

- managing expense claims,

- sending quotes and invoices,

- and chasing up late-paying customers (politely of course.)

Basically, you don’t have to go at it alone anymore. Hnry was designed by sole traders, for sole traders. We know exactly what you need to get the job done.