An invoice is an extension of your relationship with your client.

No matter how good your work is, or how incredible your products are, if you send a shoddy invoice, it’s like tripping up at the starting line. No one wants to receive a scrap of paper with a scribbled list of prices. Or, conversely, a beautiful work of calligraphy that’s missing key details.

What clients look for is a clean, detailed, professional-looking invoice, that gives them all the information they need for their records and VAT returns. Hnry’s Invoices feature gives you just that – a clear, straightforward invoice, without any fuss.

As part of your 1% +VAT Hnry fee (capped at £600 +VAT a year), you get access to all our invoicing bits and bobs, including:

- Unlimited invoices – create and send as many as you like!

- Invoice tracking – see when your clients have received, seen, and paid your invoices

- Automated chase up – we email your late-paying clients (politely!) on your behalf, so you don’t have to

- Scheduling – set an invoice up to be sent at a later date and time

- Repeat invoices – set up repeat invoices for repeat jobs

All this, in just a few clicks. Easy!

💡 If you’re VAT registered, you’ll need to provide your clients with a “VAT invoice”. If you’re not VAT registered, you should create regular invoices.

Creating a Hnry Invoice

Start by logging into Hnry.

Your Hnry Dashboard gives you a quick overview of your current outstanding invoices, as well as all your recent payments. You can also keep track of your income and your expenses claimed for the financial year.

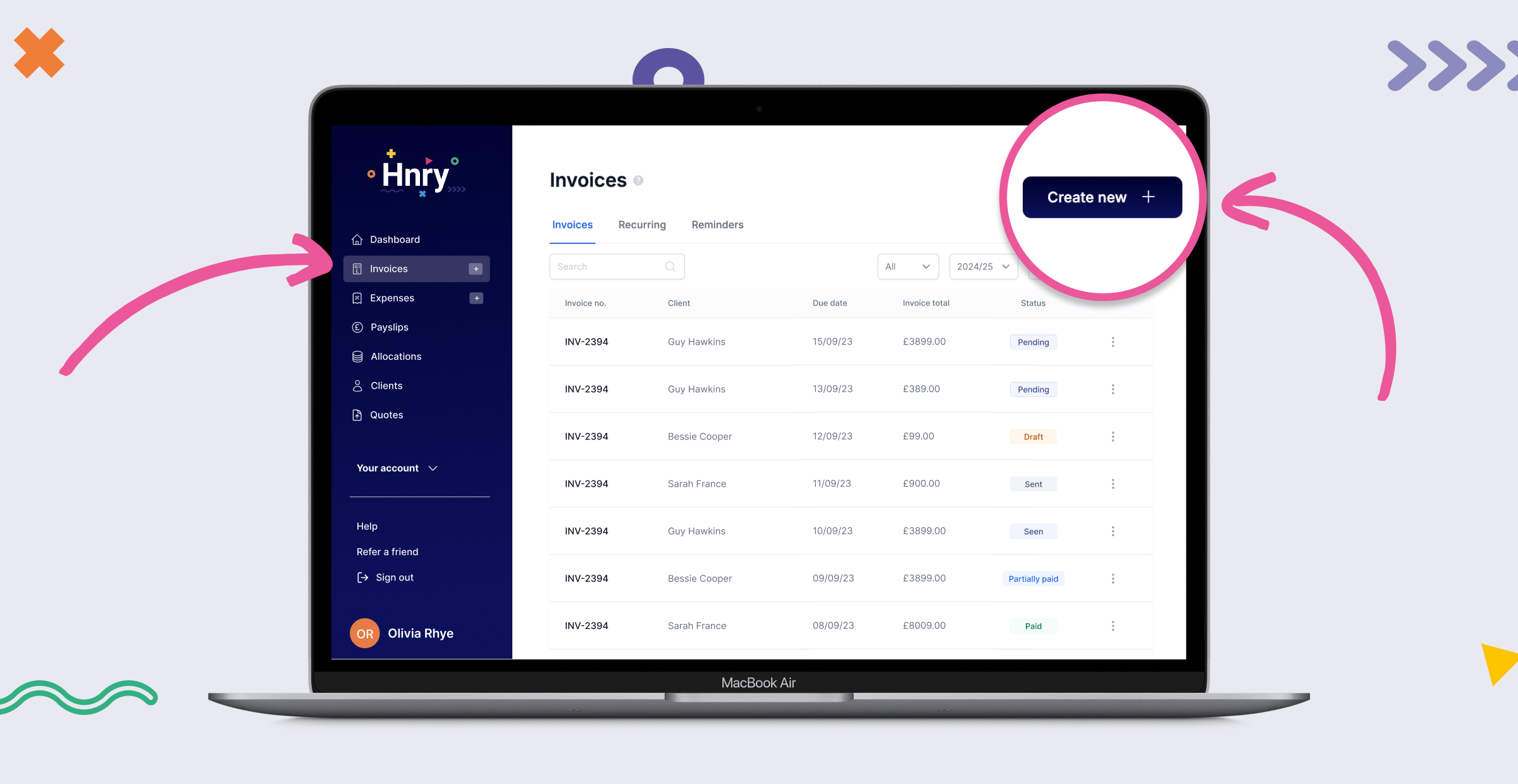

Use the menu on the left hand side to navigate to Invoices. Click the navy “Create new +” button to get started.

(If it’s your first time, whoo! The button will be in the centre of the screen instead.)

The first step in creating a new invoice is selecting your client. If you’ve already loaded your client’s details into the app, you can select them here and autofill their information.

Otherwise, you can add a new client’s details by clicking the “Create new +” button in the top right corner.

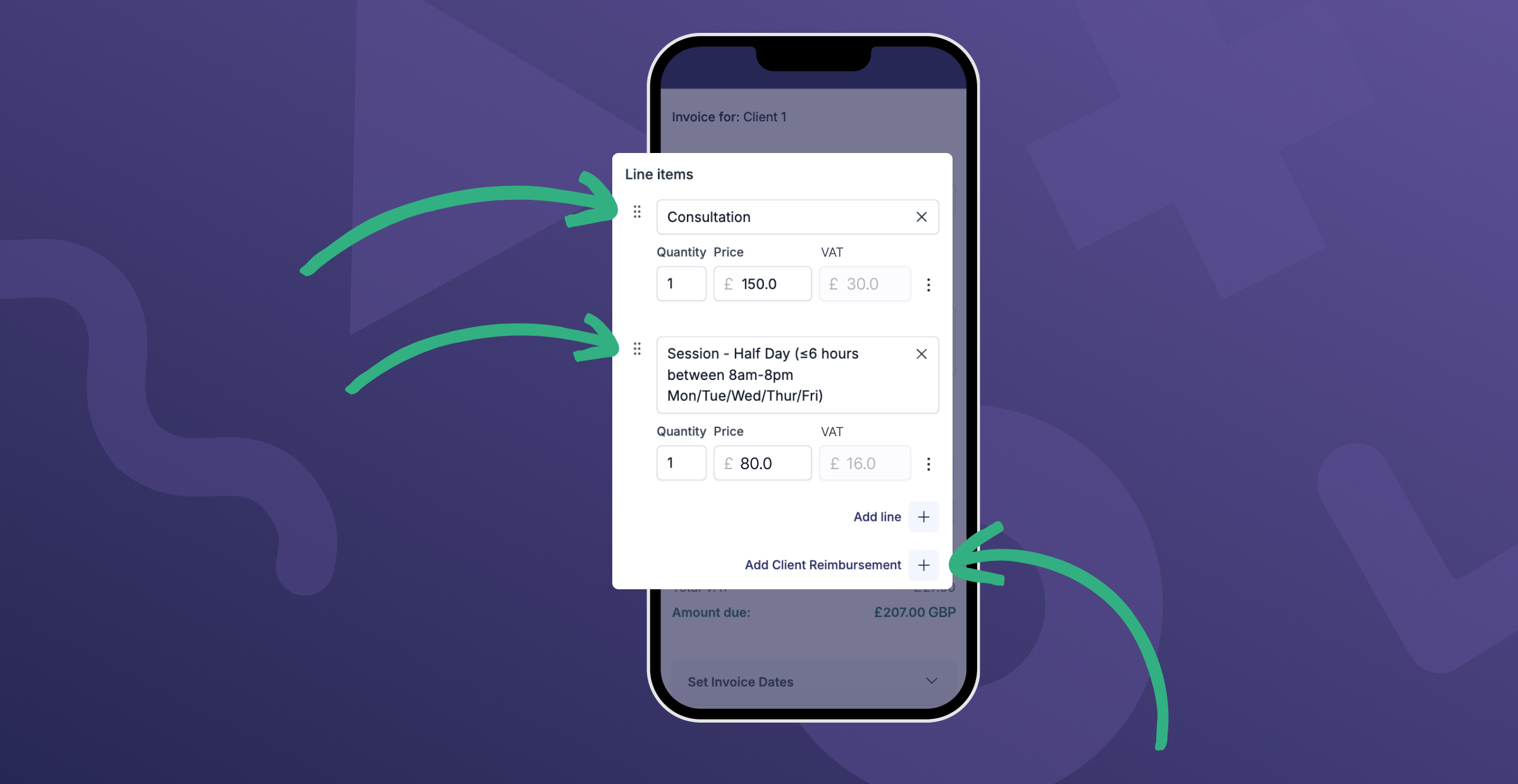

Once you’ve selected/created your client and clicked “Next”, it’s time to add job/product details to your invoice.

💡 Pro tip: you can save yourself time by pre-uploading your products/services under “Your account – Services” in the menu – they’ll now be available to choose from in a dropdown list. Otherwise, you’ll have to manually enter them every time.

The price you list (excluding VAT) should be for a single product/service. Hnry automatically calculates the total based on the quantity.

💡 If you’re VAT registered, the total price will automatically include VAT. If your services are VAT exempt, or partially exempt, you can turn VAT off for a service or client.

Client reimbursement

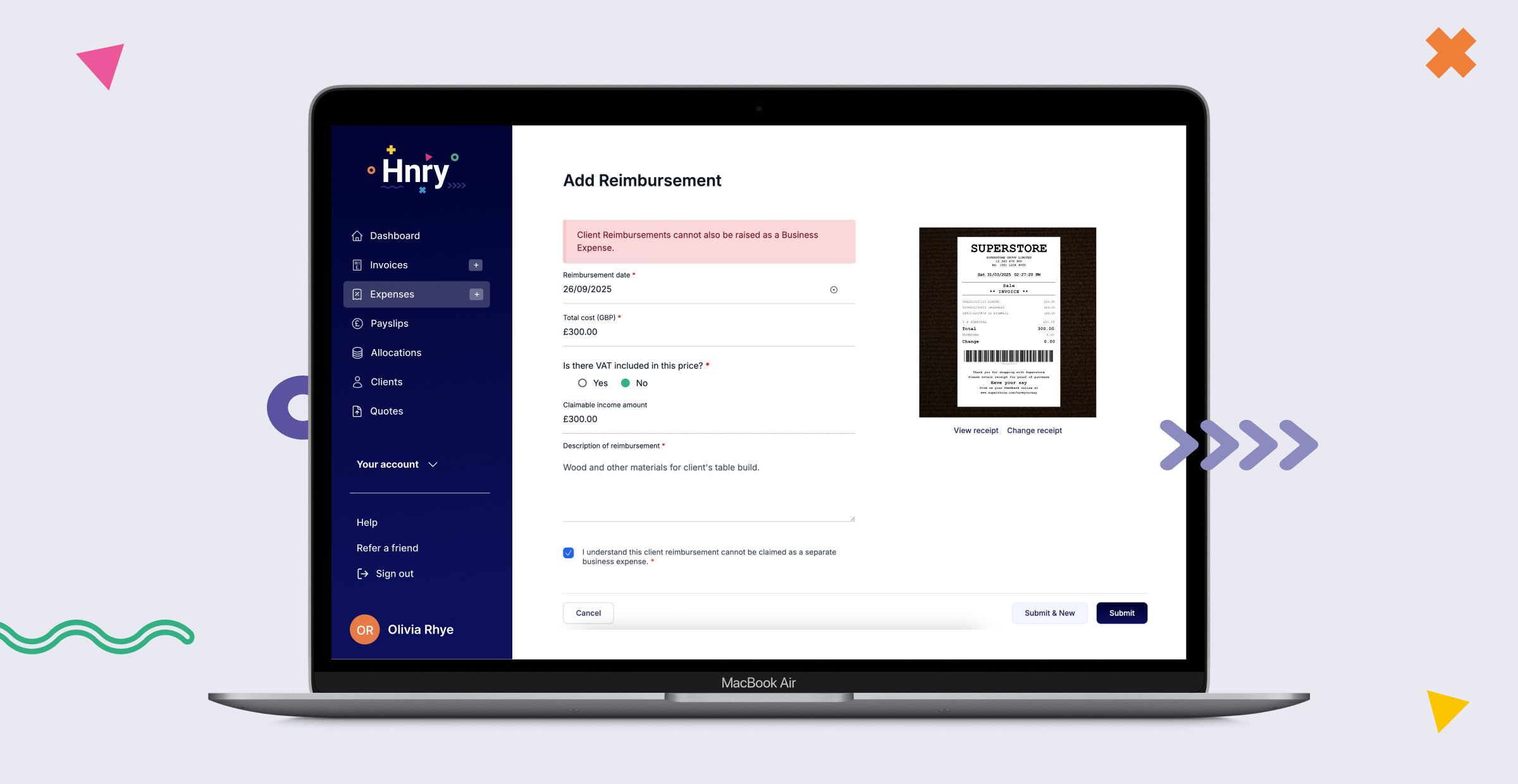

If you and your client have agreed on reimbursement for project costs ahead of time, you can add this in your invoice. Click “Add Client Reimbursement”, and you’ll be taken to the Expenses page.

(In the meantime, your invoice will be saved as a draft.)

Here you can create your reimbursement, including uploading receipts and providing a description if needed. Once you’re done, hit “Submit”.

From there, head back to your draft invoice under the Invoices tab. You should see your expense added to the invoice.

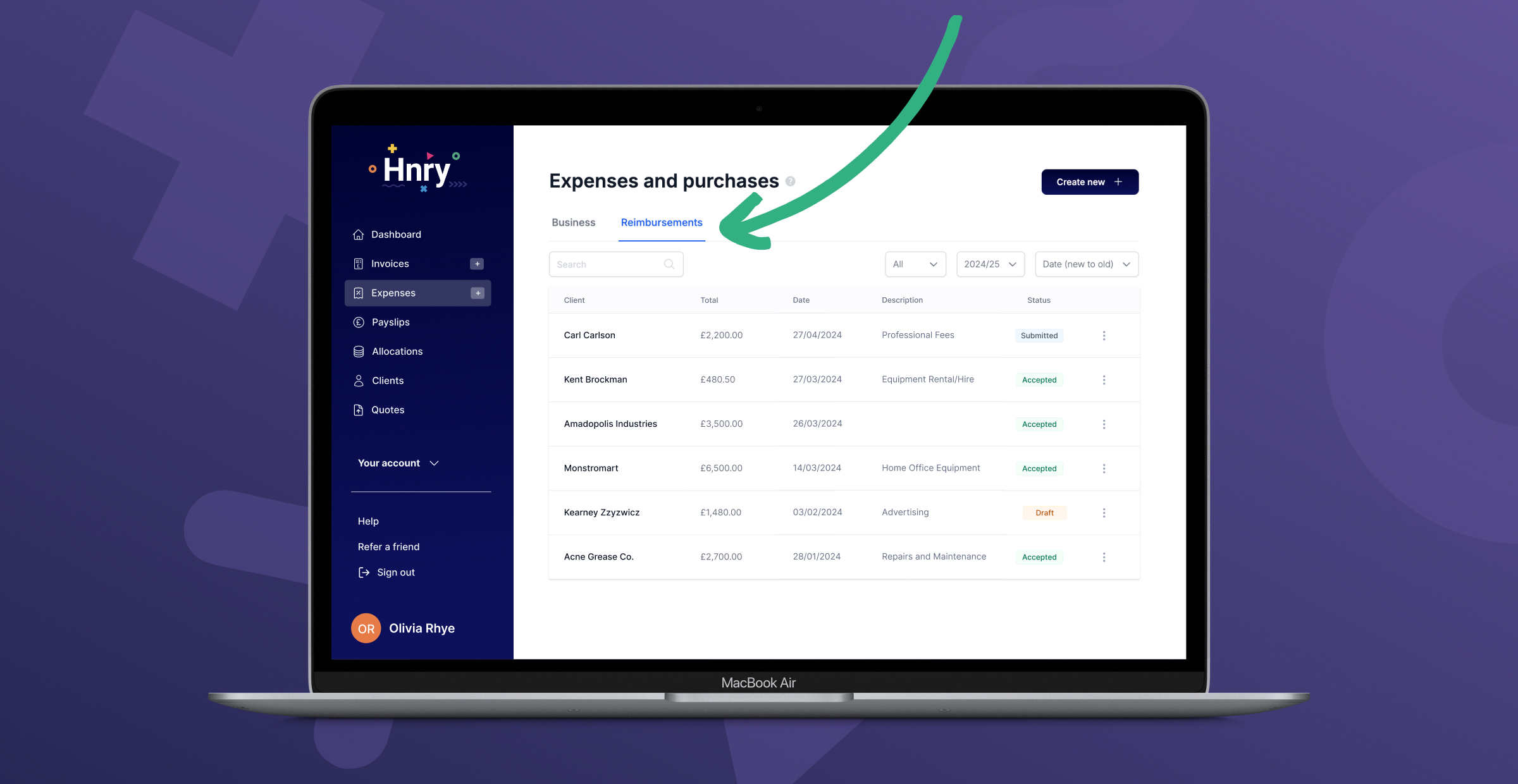

💡 You can find your Client Reimbursements under the ‘Reimbursements’ tab on the Expenses page. They’re kept separately from other business expenses, but will be managed in the same way. If you need to delete the client reimbursement from your invoice, you’ll need to delete it from the “Reimbursements” tab.

Alternatively, if you’re charging your client for materials and including a markup (and you don’t want them to know how much the materials actually cost), there’s a slightly different process.

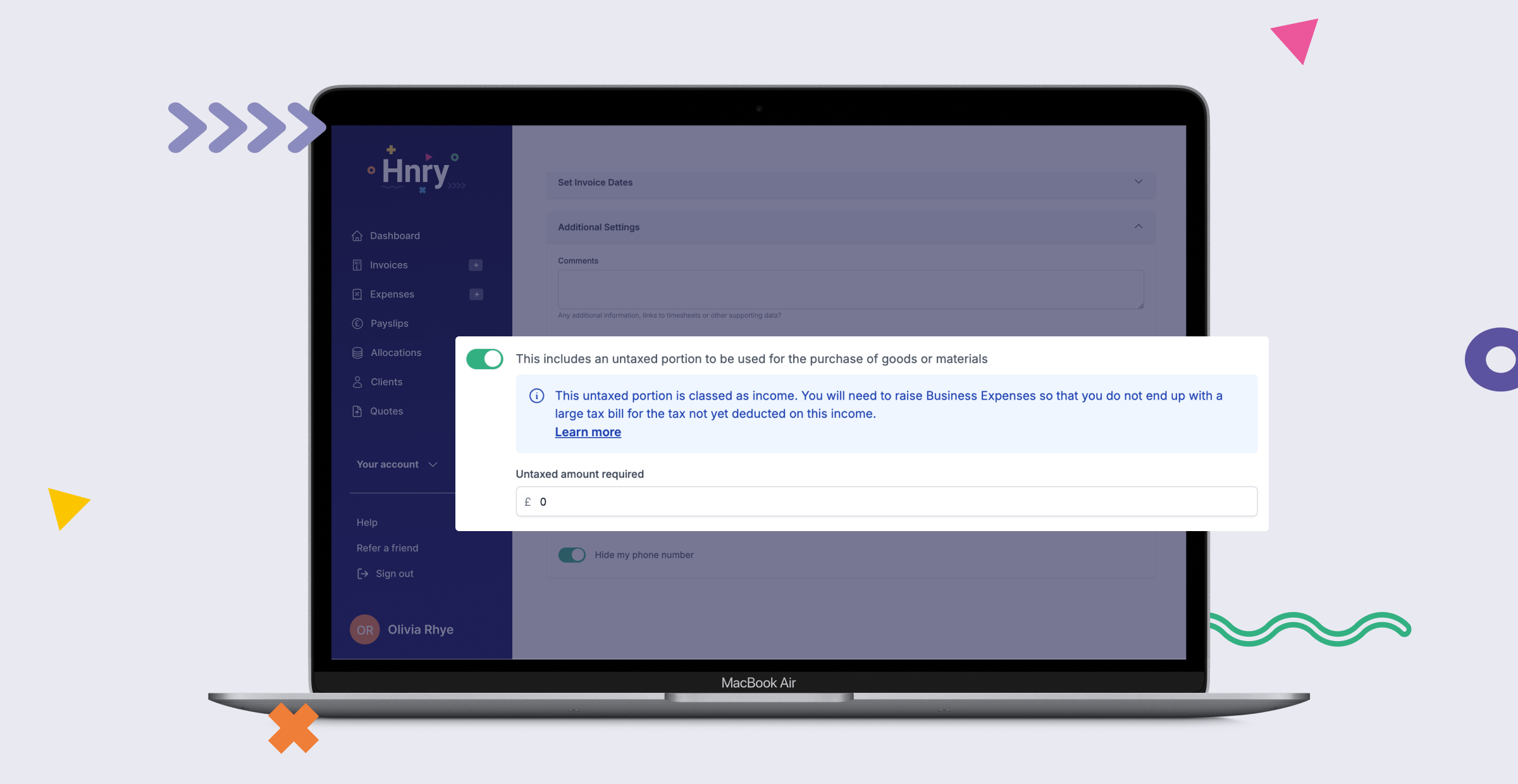

You’ll need to list the cost of materials plus the markup in the invoice for your client to pay. You’ll then need to scroll down to the “Additional Settings” section. There you’ll find a switch saying “This includes an untaxed portion to be used for the purchase of goods or materials”.

Toggle the switch on, and enter the actual cost of the materials, excluding the markup. This ensures that the Hnry system won’t deduct tax on this amount.

But don’t worry – the client will only be able to see the cost for materials you’ve actually listed in the invoice.

💡 If you’re using this option, you’ll need to raise a corresponding business expense for the materials (excluding markup) to make sure that you’re actually getting the right tax relief! You can do this under the “Expenses” tab in the menu.

Scheduling your invoice

If your client lives in a different timezone, or if you’re in the habit of doing your paperwork during random hours of the night (we’ve all been there), you can schedule your invoice to send at a more convenient time of day.

Use the “Set Invoice Dates” dropdown to choose a send date and time. From here, you can also control the date of your invoice, the due date, the start and end dates for the job, and whether or not you want the invoice to repeat.

Once you’ve finished up and clicked “Next”, the invoice will be sent at your chosen time.

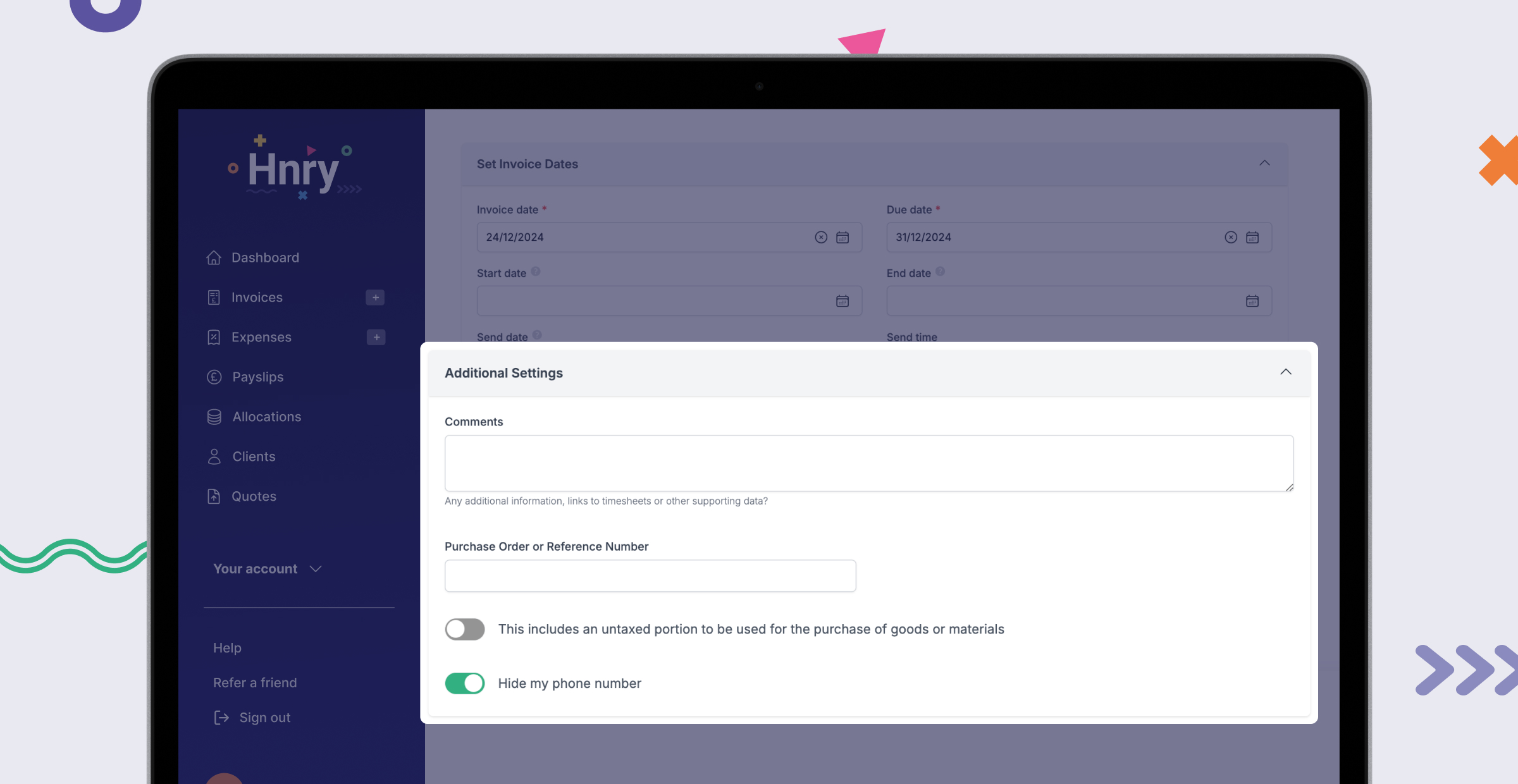

Additional settings

In the “Additional Settings” dropdown, you can add comments, or a purchase order or reference number, so you and your client can easily find it in the future.

There’s also an option to hide your phone number.

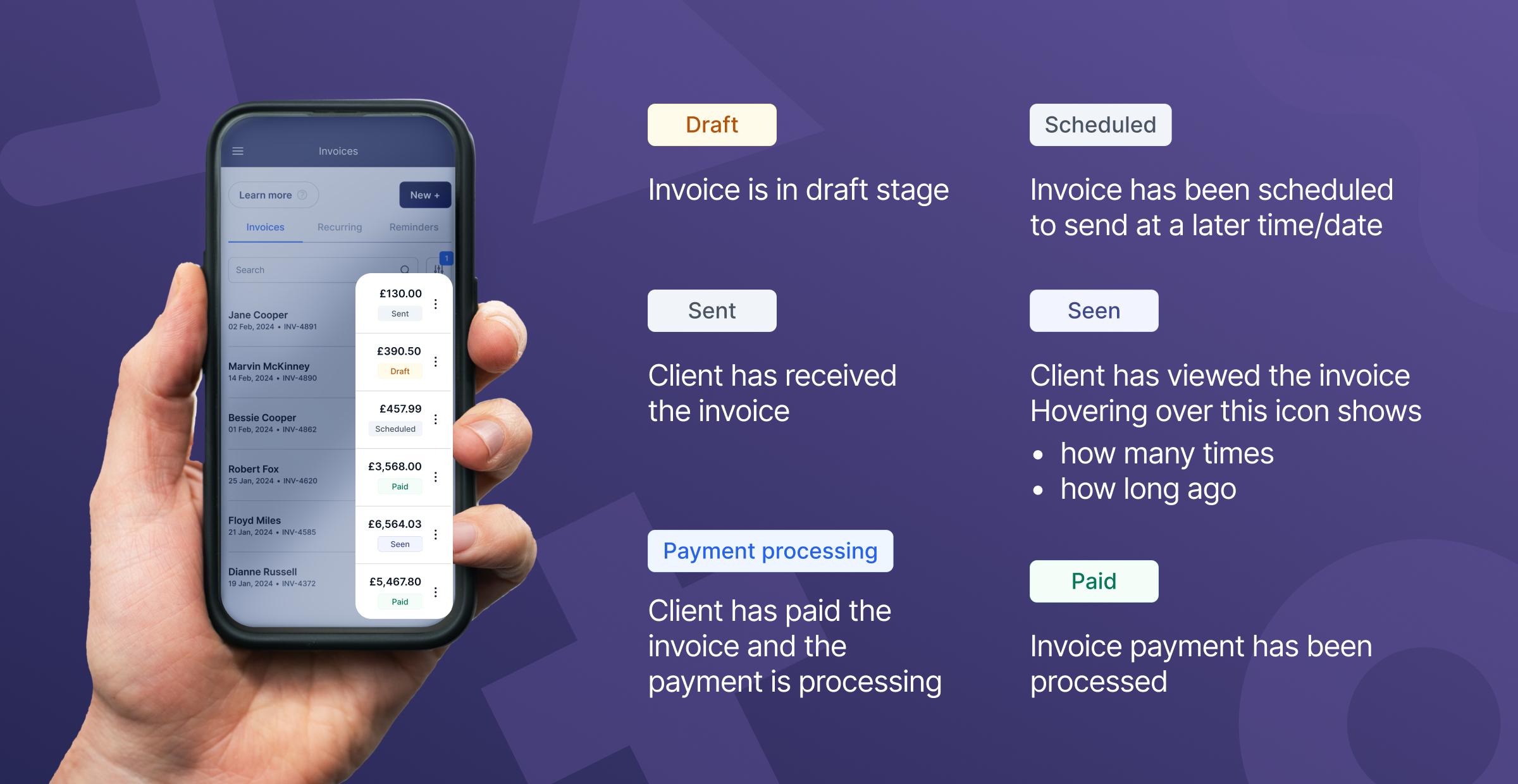

Tracking an invoice

Once your invoice has been sent, it’ll automatically appear in your Hnry Dashboard under “Outstanding Invoices”, or in your Invoices summary table.

Here, you can keep track of due dates at a glance. But what’s especially nifty are the little icons on the far right:

Once an invoice has been paid, it’ll automatically move to the “Recent payments” section of your Dashboard. Clicking on a paid invoice will show you the breakdown of all the deductions taken from the total amount, as well as income after tax. Whoo!

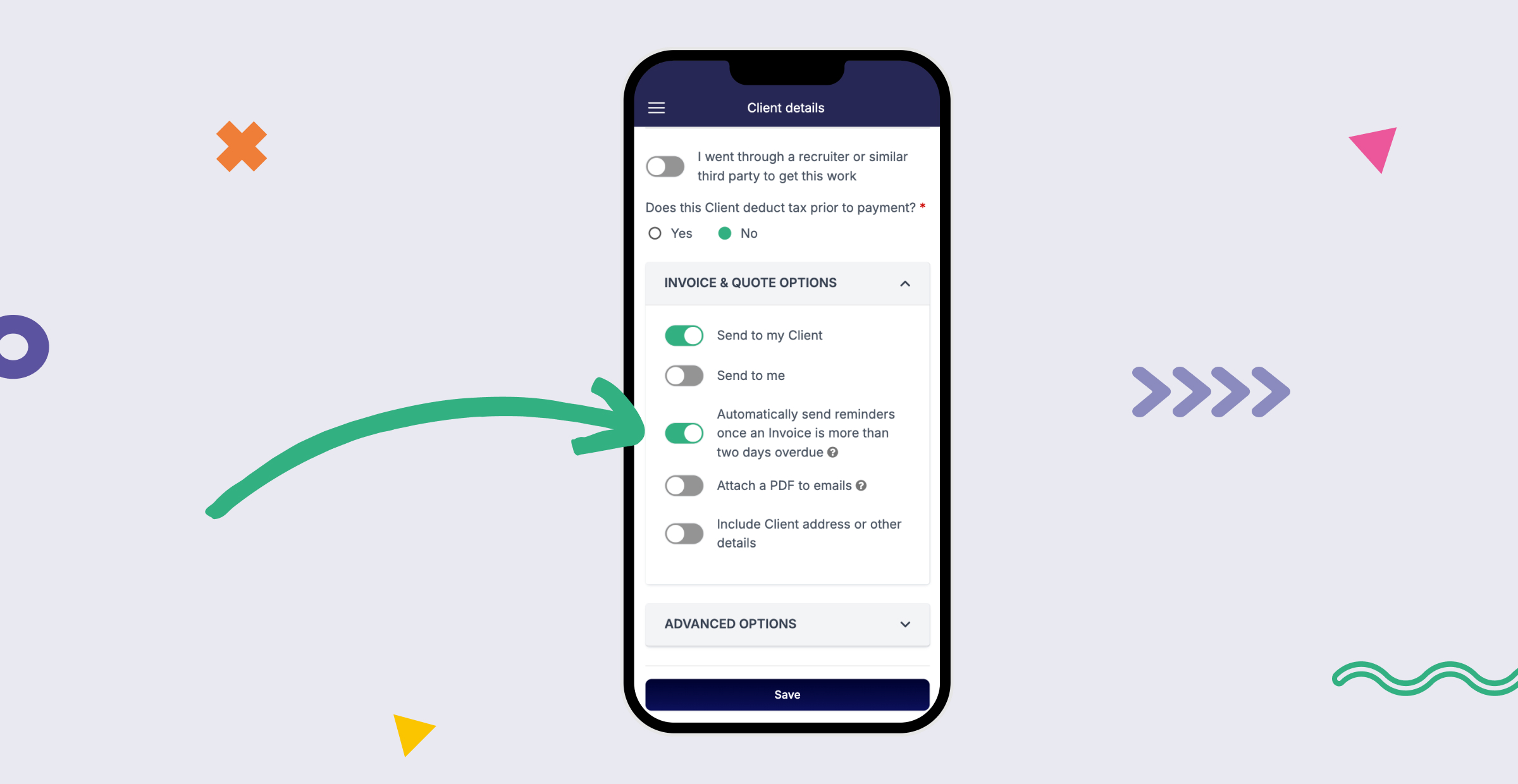

Hnry’s Invoice chasing feature

Hnry automatically sends reminder emails to clients once an invoice is more than two days overdue. Our research shows that Hnry sole traders who use this feature get paid two days after the invoice due date on average. The industry average is 10 days – not great for sole traders who have better things to do with their time than chase up unpaid invoices.

That’s why Hnry does it for you – Hnry’s automatic invoice-chasing emails are a really nifty way to get paid without endangering your relationship with your client. If they’re grumpy about being reminded they need to pay you, you can blame it on your invoicing software! (Even though they should really just, you know, pay.)

💡 Hnry will automatically chase up an invoice four times. After this, you’ll have the option to manually send reminders to your client by clicking the yellow bell icon that will appear next to the invoice.

If you don’t want to use this feature, you can disable it on a client-by-client basis. Simply navigate to the “Clients” page, select the specific client, and under “Invoice & Quote Options”, turn off the switch labelled “Automatically send reminders once an invoice is more than two days overdue”.

When your invoice gets paid, we sort your taxes

Once your client pays into your Hnry Account, we automatically calculate, deduct, and pay your:

- Income tax

- VAT (if applicable)

- National Insurance Contributions

- Student loan repayments (if applicable)

- Private pension contributions

- 1% Hnry fee (+VAT), capped at £600 +VAT annually

We can also send an optional percentage of your income to a savings account, a friend or family member, your favourite charity – the list is endless! And you can rest easy knowing that whatever ends up in your personal bank account is yours to spend.

As an added bonus, you can see what’s coming your way by previewing your Pay Summary ahead of time. Stay on top of your cash flow, and never think about taxes again!

With a high level of customisability and flexibility, our invoices are designed for all work types, in all industries. So what are you waiting for? Give it a whirl!

Join Hnry today.

Share on: