“I think I should pay more income tax,” said no sole trader ever.

If you’re self-employed, you know how hard it is to set aside a percentage of your hard-earned income to pay your taxes. Maybe you find yourself itching to use some of these funds to grow your business, or even take a well-deserved break (imagine!).

Luckily, there is a way to (legally) pay less in tax each year.

To help sole traders and small businesses keep more of their money, HMRC allows certain business expenses (called allowable expenses) to be claimed for tax relief. What this essentially means is that you’re rewarded for investing in your business, AND you get to keep more of your money come tax day. Woohoo!

Unfortunately, this tax relief system isn’t as straightforward as purchasing a business expense, then paying less tax. For starters:

- only specific business expenses qualify as allowable expenses,

- allowable expenses differ from industry to industry, and

- some purchases are only partially claimable.

So how can you make the most of this complicated system? Buckle up team. It’s time to get fiscal. Here’s what we’ll cover:

- What is an allowable expense?

- Who can claim allowable expenses?

- What expenses are eligible for tax relief?

- Types of allowable expenses

- Keeping records for HMRC

- 10 Common business expenses (as raised by Hnry users!)

- How Hnry makes claiming tax deductions easier

💡Note: This article is based on cash basis accounting – currently the default method of accounting for sole traders, and the same system we use at Hnry. Rules differ slightly for the traditional accounting method.

What is an allowable expense?

To keep it super simple, an allowable expense is a business expense that HMRC allows you to claim as tax relief.

A common misconception is that allowable expenses are deducted from the amount of tax you owe, which you then get to keep. But that’s not right.

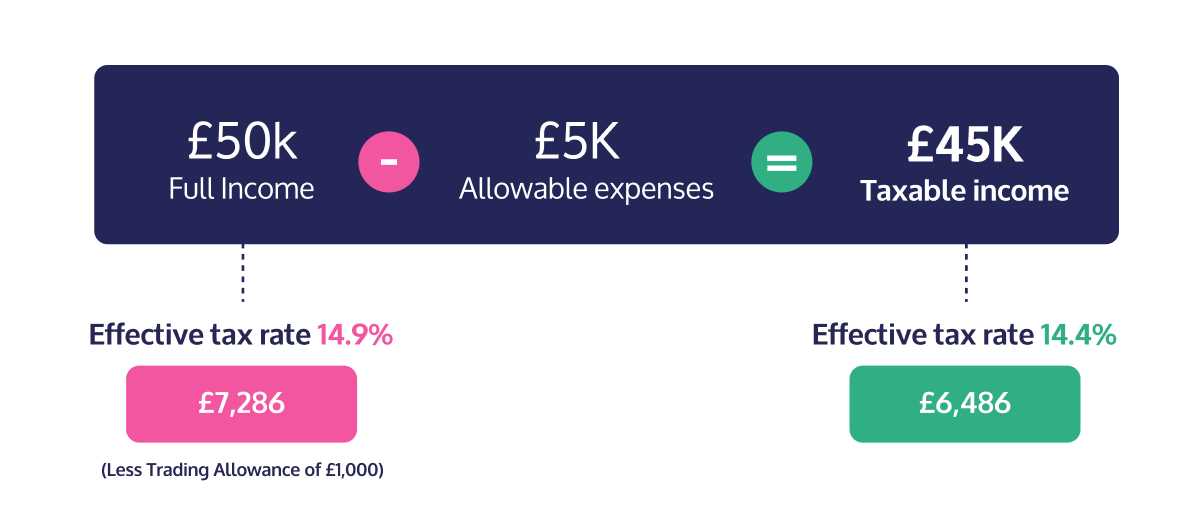

Instead, when you spend money on an allowable expense, the money spent is excluded from your taxable income – meaning you don’t have to pay tax on it. Allowable expenses reduce the amount of income you have to pay taxes on, resulting in less tax owed and a lower effective tax rate.

💡Note: An effective tax rate is the percentage of your total income that you pay in taxes. For more information, check out our guide to tax rates.

HMRC allows you to claim certain business expenses (or part of an expense) as tax relief. This means that you will owe less tax, NOT that you get this amount back as a tax refund.

Sounds confusing? Let’s break it down:

💡Note: You can calculate your own effective tax rate before and after allowable expenses using our tax calculator. For more information about how tax rates work, see our guide to tax rates for sole traders.

💡Note: If you’re VAT registered, claiming VAT expenses happens separately from claiming tax deductions.

Who can claim allowable expenses?

Technically, anyone earning an income can claim tax relief for expenses they incur in relation to their work. There are strict criteria for allowable expenses, however. As a general rule:

- You must have spent the money yourself and weren’t reimbursed.

- The expenses must directly relate to earning your income.

- You must have a record to prove it (usually a receipt).

You can also only claim the business use of an allowable expense, meaning that if you use something for both work and play, you can only claim for the percentage you use it for work.

As well as all this, allowable expenses can differ from industry to industry. For example, just because your landscaper mate Gary can claim his weedwhacker, doesn’t mean you, a photographer, can also claim yours! In this situation, it could be difficult to prove that second point – that the expense of a weed whacker directly relates to you earning an income.

Finally, although technically anyone can claim a work-related expense, the rules differ for PAYE employees as the company they work for usually covers work-related costs. Those who try to work the system can end up falling foul of HMRC – ouch!

But for sole traders, claiming allowable expenses is a brilliant way to pay less in tax, while spending more money on their business. No dodgy tax advice required.

💡Note: Remember: if an expense is for both business and personal use, you can only claim costs for the business usage.

📖 Further reading: For more information on both business and personal tax deductions, check out HMRC’s handy guide to self-employed expenses.

Allowable expenses vs. tax relief

Hang on. What exactly is the difference between a business expense, an allowable expense, and tax relief?

These terms are sometimes used interchangeably, but they’re actually not the same thing. Not all tax relief comes from business expenses, and not all expenses result in tax relief. The more you know!

Simple! Yet confusing. We hear you. Let’s dive in.

Business expenses

Business expenses are the costs you incur as part of running your business day-to-day. Basically, if you need something to help you get the job done, that purchase will be a business expense.

BUT HMRC won’t automatically accept every business expense as an allowable. As we’ve already talked about, they have strict criteria for what is and isn’t eligible.

A good example is work clothes. HMRC only allows deductions for mandated uniforms, clothing with logos, and health and safety equipment. Even if you only use certain clothes for work, if they could feasibly be worn outside of work, you’re out of luck.

Allowable expenses

An allowable expense is exactly what it says on the tin: it’s a business expense that qualifies for tax relief under HMRC’s rules.

If your expense meets all the criteria, it’s most likely an allowable expense. You can claim it to reduce your taxable income and therefore lower your tax bill.

Speaking of which –

Tax relief

We’ve already covered how allowable expenses work when it comes to tax relief. But tax relief is actually quite a broad term that covers a whole host of other measures!

Very simply, “tax relief” could apply to anything that lowers the tax you owe. We’re talking things like:

Allowances

Personal Allowance: Everyone earning an income through work is entitled to a personal allowance of £12,570 tax free. This means you won’t owe income tax on the first £12,570 you earn.

Trading Allowance: We mentioned this one earlier, but sole traders are eligible for a tax-free Trading Allowance of £1,000. The caveat is that you can’t claim allowable expenses on top of this – they’re included in the Trading Allowance.

If you plan to claim business expenses, you’ll need to do this instead of claiming the Trading Allowance.

Private Pension Contributions

HMRC allows sole traders to claim “relief at source” for private pension contributions – an additional 20% of your contributions added to your private pension pot (so long as your income is below £50,570).

If you pay tax at the basic rate, this tax relief is automatically applied by your pension provider. If you pay tax at the higher/additional tax rate, you can claim further tax relief you’re entitled to through your Self Assessment.

Rules differ slightly if you’re based in Scotland. For more information, check out our pension tax relief explainer.

Gift Aid

If you’re a higher-rate taxpayer, and you contribute to a registered charity, they’ll be able to claim an additional 25% of your donation back from HMRC, and you’ll be eligible to claim a further 20% of the gross donation as tax relief.

So if you donate £100, the charity will be able to claim an additional £25 (25% of your donation), and you can claim a further £25 (20% of the original £100 + £25 claimed by the charity) via your tax return.

For additional-rate taxpayers, the claimable percentage is upped to 25% of the gross donation.

Tada!

This is by no means a complete list – just a start. But with all this in mind, let’s update that snazzy venn diagram:

Examples of allowable expenses

Industry-specific deductions

HMRC’s guidelines are actually just a starting point – like we’ve already mentioned, claimable expenses differ between industries and contexts. For example:

- A judge could claim the cost of judicial robes – but a tradie couldn’t

- A tradie could claim a hard hat they need to keep them safe – but not a judge

Because of this, you can’t automatically claim everything your friends and family claim – their allowable expenses might not be applicable to your industry.

Partially-claimable expenses

Some business expenses are also only partially claimable. For example, you can only claim for:

- The business use of a work vehicle, not the personal

- The percentage of your internet bill you used for business purposes while working from home

💡Note: You need to be able to prove that an eligible expense was partly or solely for business use. Otherwise, it might not fly with HMRC.

If in doubt about an expense, you should run it by your accountant or tax agent (or the friendly Hnry team!).

Capital Assets

Finally, there are capital assets, which are claimed a little differently.

A capital asset is an asset that has a longer useful life (a year+), that’s not a day-to-day business cost. Think equipment, furniture, vehicles – that sort of thing.

Under the cash-basis accounting method, capital assets are generally claimed in whole in the year they’re purchased, just like any other allowable expense (providing they meet the criteria for an allowable expense).

The exception to this rule, however, is vehicles. Vehicles will need to be claimed using capital allowances, but how you go about doing this will depend on the type of vehicle.

Electric cars, for example, are 100% claimable under the 100% first-year allowance.

Cars with CO₂ emissions over 50g/km must use the main rate pool (18%), while those with emissions over 110g/km fall into the special rate pool (6%). These rates remain the same in subsequent years but are applied to the remaining balance each year — not the original cost of the car.

You can find more information about claiming capital assets on the HMRC website.

💡Note: Remember, like with allowable expenses, you can only claim the business use of a capital asset.

🙋♀️ Did we mention Hnry sorts this all for you? Simply raise the capital asset like a regular expense, and we’ll do the rest. See how it works.

Keeping records for HMRC

There’s nothing worse than putting hours of blood, sweat, and tears into your financial admin, only to realise at the end of the financial year that you’ve lost the receipts!

Keeping clear, organised records of purchases and goods/products sold will help make tax time as stress-free as possible. It’s also good practice; HMRC requires you to save a record of your expenses (receipts) for five years after purchase, either physically or digitally.

Imagine five years worth of receipts strewn across your office floor, and you can see why a good filing system is super important!

That’s where Hnry comes in. You can raise expenses in our app, and we’ll manage them for you. We calculate your tax savings from expenses as you go, giving you immediate tax relief. Plus, we store your receipt photos for you for the required five years – no shoebox required, ever again!

For bonus points, you could also use the Hnry Business Mastercard. Every time you use it to make a purchase, it automatically raises an expense in the Hnry app, so nothing slips through the cracks. From there, all you need to do is upload a pic of your receipt, confirm a few details, and you’re done. Expenses sorted!

10 most common business expenses (as raised by Hnry users!)

Now we get to the fun stuff! Here are the top 10 most-raised expenses for our users in the last financial year:

-

Motor vehicle expenses

You can claim all vehicle costs as allowable expenses. If a vehicle is for both business and personal use (say it with us now), you can only claim the business percentage of the costs. -

Equipment purchases

Any equipment purchased that you need in order to do your job e.g. mobile phones, software, camera equipment, tools. And again, if the equipment is for both business and personal use, you can only claim the business portion of the cost. -

Cost of Goods Sold

Any costs incurred in order to create/produce your products/services are entirely tax deductible. Whoo! -

Subscription fees

Any recurring subscription costs for business-related products e.g. recurring software costs, online magazines, newspaper magazine subscriptions, licensing fees. -

Mobile phone bill

Remember, if the phone is for both business and personal use, you can only claim the percentage of the bill that was for business use. -

Light, power, and heating

If you work from home, you can claim the business percentage of your light, power, and heating bills. You’ll need to calculate this percentage using a reasonable method – for example, using the percentage of your home dedicated to your home office. -

Rent (home office)

Just like with light, power, and heating, the deductible portion of your rent depends on the size of your home office. -

Internet and landline

As with your mobile phone bill, you can only claim for the cost of business use of your internet. You also can’t claim a deduction for installation or set-up costs. -

Advertising costs

This covers any costs of advertising your work in any way. So go ahead and commission that billboard you’ve been dreaming about forever (we’re mostly kidding). -

Travel costs

Any travel costs incurred for certain work-related trips are tax deductible. But the trip does actually need to be for work – you can’t fly to Bora Bora, attend a wedding, drink cocktails on the beach, and then expense it!

How Hnry makes claiming expenses easier

We may be biased, but we believe that the best way for sole traders to maximise their tax deductions (legally) is to use Hnry.

Hnry is an award-winning service that’s helping sole traders spend less time on financial admin, and more time doing what they love (unless what they love is financial admin). For just 1% +VAT of your sole trader income, capped at £600 +VAT a year, we calculate, deduct, and pay all your taxes and whatnot for you, including:

- Income tax

- VAT

- National Insurance Contributions

- Student loan repayments

- Private pension contributions (optional)

… meaning you won’t have to think about any of that. Ever. We’ll even complete your Self Assessment for you, at no additional cost.

Raising expenses through our app is as simple as taking a photo of your receipt and inputting a few extra details. From there, our tax experts will manage and claim your expenses, so you get the tax relief back in your pocket in real time (rather than having to wait until the end of the financial year). Easy as!

Get your tax ducks (and deductions) in a row by joining Hnry today!

Share on: